Search posts

Be careful what you wish for

Be careful what you wish for

The RBA cut the cash rate 0.25% to 1.00% in June. The cash rate is at a record low. Bond markets are pricing in more cuts. Australian equities have rallied to fresh highs. The Aussie dollar has rallied. Investors’ wishes have come true. Be careful what you wish for. The RBA has cut rates for a reason. The economy is slowing. Bond markets have not priced in enough easing. Equity markets have ignored slowing fundamentals. The Aussie dollar needs to fall further. The medium-term economic outlook is challenging. Asset returns are going to be low on average. Investors that prepare now will be better insulated from market panic in the future.

The RBA has cut rates for a reason

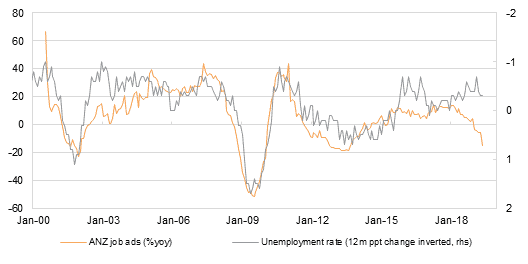

Australia’s economic outlook has deteriorated faster than even we expected. Slow income growth and falling housing wealth has depressed consumer spending. Housing investment is falling. Private sector credit growth is trending lower. Business investment is falling. Leading indicators of the unemployment rate have turned sharply negative (Figure 1). Global growth peaked in late-2018 and momentum suggests further downside.

Figure 1: Job ads have deteriorated, suggesting the unemployment rate could turn higher

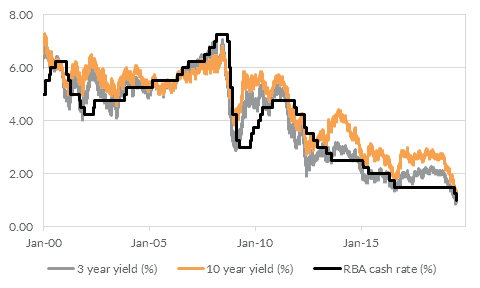

We estimate that around 300-400bps of rate cuts will be required to drive an economic recovery. The RBA went in to this slowdown with 150bps. The RBA has now cut the cash rate to 1.00% (Figure 2). Rates will go lower. And as we argued in March, the end-game is likely to be Quantitative Easing.

We estimate that around 300-400bps of rate cuts will be required to drive an economic recovery. The RBA went in to this slowdown with 150bps. The RBA has now cut the cash rate to 1.00% (Figure 2). Rates will go lower. And as we argued in March, the end-game is likely to be Quantitative Easing.

Figure 2: Cash rates and bond yields are at historic lows

Asset returns will be low on average

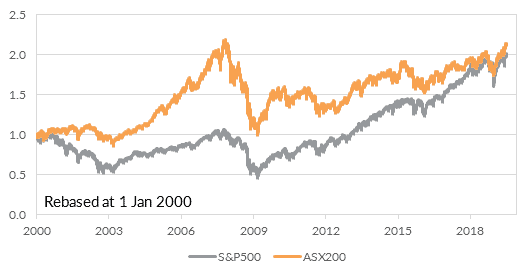

Lower rates have acted like a sugar rush for equity investors (Figure 3). The impact is twofold. Lower interest rates directly reduce the discount rate for future earnings. A lower discount rate increases the present value of those earnings. The shift to an easing bias can also reduce the risk premia in the near term. That further reduces the discount rate.

Figure 3: Global equities have rallied to be around record highs

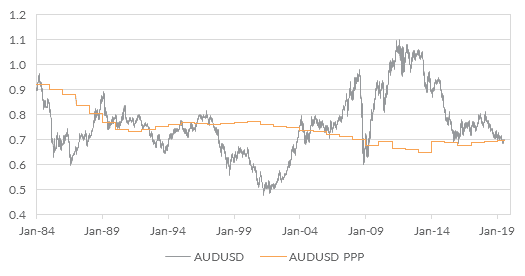

In the near-term, the rate cuts have effectively bought forward returns from the future. But we think fundamentals will play out over the medium-term. We expect earnings growth will slow as sales growth turns negative and margins compress. A typical drawdown during these episodes is between 25-30%. On average, that points to very low equity returns over the coming five years. Fixed income markets and term deposits will also be impacted. Term deposit rates will fall with the cash rate. Consider Europe as an example. The European Central Bank has a negative policy rate. Term deposit rates available to investors are positive but sit close to zero. We expect Australia is heading in that direction over the medium-term. Australian Government bond yields have reached historic lows (Figure 2). But they still do not fully reflect what we think is the likely path for cash rates. There is scope for yields to fall further from current levels. We think Australian Government bonds continue to offer reasonable risk-adjusted returns over the medium term. Currencies will be an important driver of returns in a world of low and falling interest rates. The Aussie dollar is currently around its long-term fair value (Figure 4). Forwards (which simply reflect interest rate differentials) point to appreciation. We expect the combination of Australian and global recession, and near-zero interest rates, will drive the Aussie dollar much lower than current levels. Australian investors in international equities need to consider this when deciding their hedge settings.

In the near-term, the rate cuts have effectively bought forward returns from the future. But we think fundamentals will play out over the medium-term. We expect earnings growth will slow as sales growth turns negative and margins compress. A typical drawdown during these episodes is between 25-30%. On average, that points to very low equity returns over the coming five years. Fixed income markets and term deposits will also be impacted. Term deposit rates will fall with the cash rate. Consider Europe as an example. The European Central Bank has a negative policy rate. Term deposit rates available to investors are positive but sit close to zero. We expect Australia is heading in that direction over the medium-term. Australian Government bond yields have reached historic lows (Figure 2). But they still do not fully reflect what we think is the likely path for cash rates. There is scope for yields to fall further from current levels. We think Australian Government bonds continue to offer reasonable risk-adjusted returns over the medium term. Currencies will be an important driver of returns in a world of low and falling interest rates. The Aussie dollar is currently around its long-term fair value (Figure 4). Forwards (which simply reflect interest rate differentials) point to appreciation. We expect the combination of Australian and global recession, and near-zero interest rates, will drive the Aussie dollar much lower than current levels. Australian investors in international equities need to consider this when deciding their hedge settings.

Figure 4: The AUD is currently close to its long-run fair value. We see downside risks

Now is the time to prepare

Markets are pricing strong economic and earnings growth. Risk asset valuations are stretched. Bonds are not fully pricing the extent of monetary policy necessary. Term deposits are going to fall further. It is a challenging outlook for investors. Asset returns are likely to be lower than historic averages. That will put pressure on investors’ financial positions. Investors that have a clear, repeatable process for dynamically adapting to market moves will be better prepared. Seek insights from trusted investment advisor. Contact Oreana Financial Services or your affiliated Advisor to find out how we can assist with managing your wealth.

Data sources: Bloomberg LP, Oreana Financial Services

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).