Search posts

Don’t collapse under the weight of expectations

Expectations can be a heavy burden to bear. When reality fails to meet expectations, we are usually surprised and sometimes disappointed. This is as true in financial markets as it is in life. Sensible portfolio construction and asset allocation is about minimizing those surprises and disappointments. Last month, I shared that I expect the US is heading for recession. On top of that, I think it will be a global recession. Do asset markets expect the same outcome? And if not, what are the risks to our portfolios and how can we mitigate those risks? In this month’s CIO Insights, I answer these questions and shed light on how we are looking to protect our portfolios.

Bond markets are pricing too few rate hikes

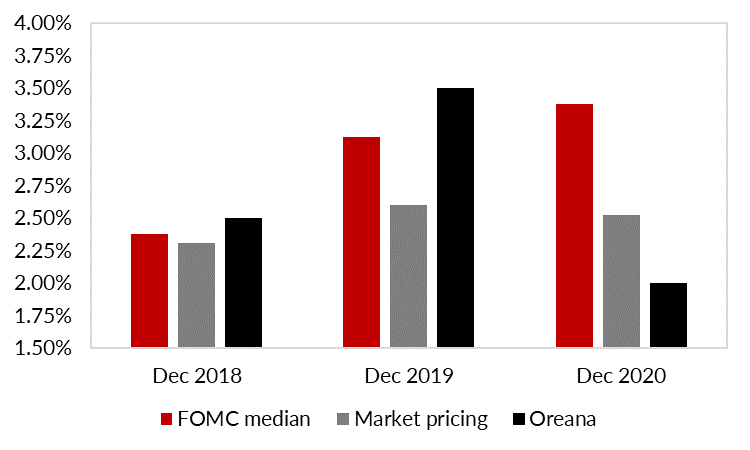

Figure 1 shows the US Fed expects its Fed Funds rate to be around 3.00%-3.50% by end-2020.

Figure 1: Expectations for the Fed Funds rate

Source: Bloomberg LP, Oreana Private Wealth Markets expect a considerably lower rate. I expect the Fed will end up hiking to 3.50%, before a recession forces rate cuts in 2020. There is an expectations gap between the market and the Fed. If the Fed imposes its view on markets, investment grade bonds are likely to deliver low returns over the coming 18-24 months. But if a recession follows, bond returns will be boosted in the subsequent 18-24 month period.

Source: Bloomberg LP, Oreana Private Wealth Markets expect a considerably lower rate. I expect the Fed will end up hiking to 3.50%, before a recession forces rate cuts in 2020. There is an expectations gap between the market and the Fed. If the Fed imposes its view on markets, investment grade bonds are likely to deliver low returns over the coming 18-24 months. But if a recession follows, bond returns will be boosted in the subsequent 18-24 month period.

Equity markets are priced for solid earnings growth

Equity market prices embed the present value of a series of cash flows discounted back using an appropriate interest rate. This leaves scope for surprise from two fronts. Interest rates that are higher than expected can reduce returns. Similarly, earnings that are weaker than expected can reduce returns. Late-cycle dynamics tend to coincide with reasonable economic strength and earnings growth. This should help offset the impact of higher-than-expected rates over the next 18-24 months. Beyond that period, a recession would drive earnings and returns lower than current market expectations. I still think it is too soon to reduce equity risk. Doing so would forego solid return potential during this late-cycle period.

Credit market pricing doesn’t reflect the risks

Credit spreads in both investment grade and high yield markets are currently below long-run averages. This indicates markets expect favourable conditions for corporate balance sheets. The current level of spreads does not compensate investors for taking on the default risks associated with recession. Risks are tilted towards returns that are disappointing relative to history. I am winding back portfolio exposure to credit as a result.

How do we protect against the divergent outlook?

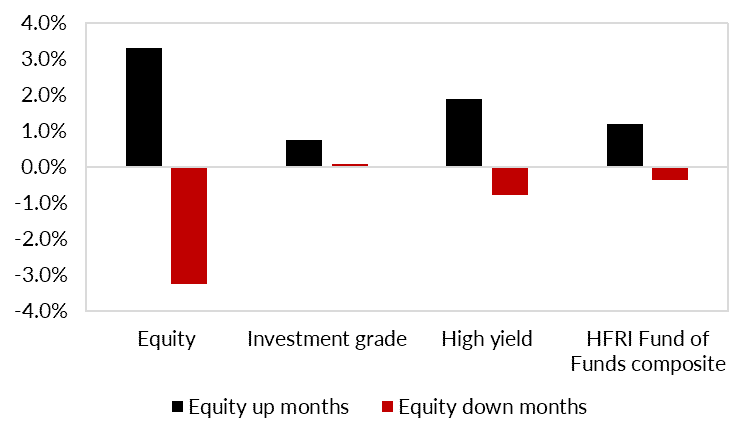

Return profiles look very different over the next 18-24 months compared against the subsequent 18-24 months. I believe dynamic asset allocation can help manage that divergence. Dynamic asset allocation involves adjusting the exposure to different asset classes in response to the outlook. Diversification is the other important lever that can be used to prepare for this outlook. Diversification within a portfolio can be achieved to some extent by investing across traditional equity and fixed income assets. But it can be enhanced by allocating to alternatives. Within the portfolios, alternatives refer to a broad range of strategies not covered by conventional equity and fixed income asset classes. Equity long/short, global macro hedge funds and multi-asset funds represent just a few of these. Figure 2 shows that in periods when equities perform poorly, investment grade bonds have provided a small positive return on average. This happens because investment grade bonds can offer returns that move in the opposite direction to equity returns, under some environments.

Figure 2: Average returns in equity market up and down months

Source: Bloomberg LP, Oreana Private Wealth Figure 3 shows that the reverse is not true. On average, equities performed poorly when investment grade bonds performed poorly.

Source: Bloomberg LP, Oreana Private Wealth Figure 3 shows that the reverse is not true. On average, equities performed poorly when investment grade bonds performed poorly.

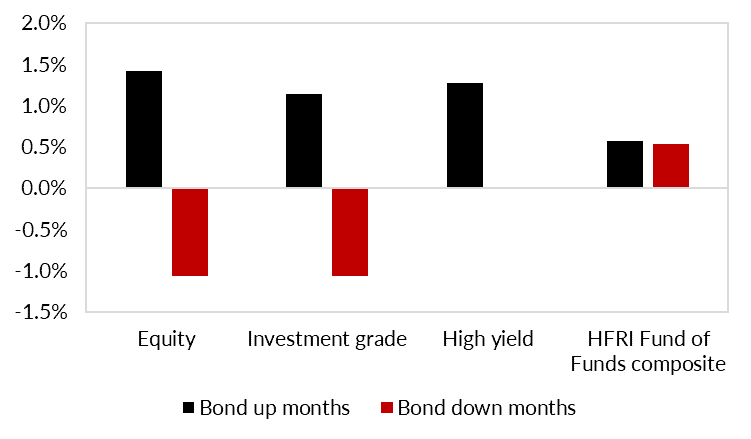

Figure 3: Average returns in bond up and down months

Source: Bloomberg LP, Oreana Private Wealth Importantly, alternatives (proxied by the HFRI Fund of Funds Composite in Figures 2 and 3) provided better returns in both equity and bond down markets. That protection when it is most needed is an attractive feature of good alternative investments.

Source: Bloomberg LP, Oreana Private Wealth Importantly, alternatives (proxied by the HFRI Fund of Funds Composite in Figures 2 and 3) provided better returns in both equity and bond down markets. That protection when it is most needed is an attractive feature of good alternative investments.

Summary

I think market expectations are still too optimistic about the medium-term outlook. The resulting market disappointment could be challenging for portfolios heavily invested in equity and high yield credit. Our portfolios use dynamic positioning to help protect against the risk. Equally important is increasing allocations to alternatives. The goal is to diversify portfolio risk against the chance those optimistic market expectations are disappointed. If you have questions or want to know more about how we can help position your portfolio to prepare for the volatility ahead, please contact your advisor directly or get in touch with us for investment advisory service and more.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorized copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorized personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorized use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).