Search posts

The temptation of missed opportunities

The ferocious equity market rally through Q1 2019 has largely unwound the bear market experienced through 2018. But one of the key refrains heard through Q1 has been that this has largely been a flowless rally. This means that after being burned through Q4, many investors have been sitting on the sideline and missed the upside opportunity. These investors now face the temptation of chasing missed returns in the hope the rally continues. When markets move aggressively, we think it is even more important to have a repeatable, fundamentals-based and credible investment process to rely on. This allows us to ask:

- Have the underlying fundamentals changed materially?

- Does the market pricing reflect the underlying fundamentals?

- Is this a sentiment and momentum driven price action?

- Which asset class will give us the best risk adjusted returns over the medium-term?

Table 1: Equity markets have rallied aggressively to end March-2019

Have the underlying fundamentals changed materially?

We expect a recession to take place in the US at some stage near the end of 2020. That has been our base case through 2018. Leading indicators began to support that thesis in late-2018.

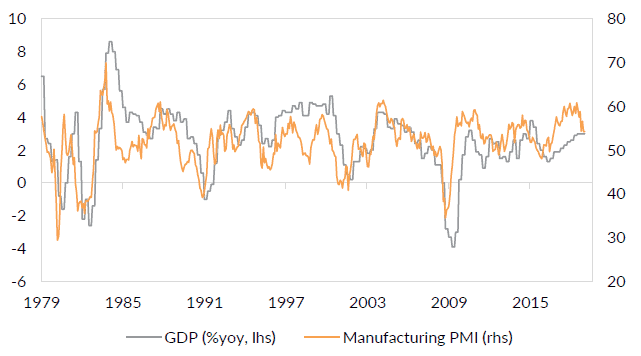

Fig 1: The US Manufacturing PMI has peaked, suggesting slowing (but still positive) growth

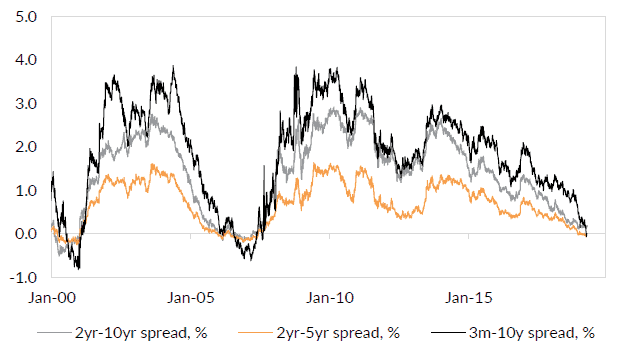

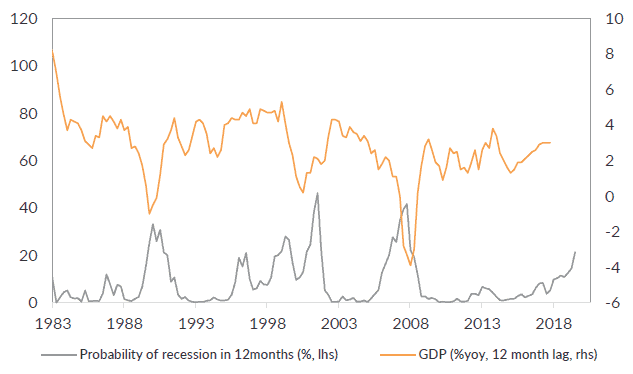

Leading indicators of US growth peaked and have turned lower (Fig 1). The US yield curve inverted (Fig 2). This means that longer dated Treasury yields were below shorter dated Treasury yields. Yield curve inversion has been a reliable indicator of recession for decades. The probability of recession in the next 12 months has picked up (Fig 3). We expect it will increase further over the next 12 months.

Leading indicators of US growth peaked and have turned lower (Fig 1). The US yield curve inverted (Fig 2). This means that longer dated Treasury yields were below shorter dated Treasury yields. Yield curve inversion has been a reliable indicator of recession for decades. The probability of recession in the next 12 months has picked up (Fig 3). We expect it will increase further over the next 12 months.

Fig 2: The US Treasury yield curve has inverted across several maturities

Fig 3: The probability of recession over the next 12 months is at the highest level since 2007

We have not materially changed our fundamental economic outlook. We continue to expect growth to slow through 2019 and 2020. After a lengthy period of economic expansion, we think economic risks are skewed to the downside.

We have not materially changed our fundamental economic outlook. We continue to expect growth to slow through 2019 and 2020. After a lengthy period of economic expansion, we think economic risks are skewed to the downside.

Does the market pricing reflect the underlying fundamentals?

We think that the recent surge in equity prices does not reflect a material change in the fundamental economic outlook. Instead, our models suggest the current price level through most of the developed and emerging market equities is discounting earnings growth materially higher than what is likely to be achieved on average over the next five years. Mispricing is also evident in bond yields, in our view. The bond market currently is priced for modest rate cuts over the next 5 years (Fig 4). We think that means the bond market has started to price the possibility of a recession at some stage.

Fig 4: US bond yields are priced for moderate rate cuts over the next 5 years

We estimate that around 400-500bps of rate cuts are required to drive a recovery in the case of recession. Bond yields are currently discounting 50bps of cuts. There is scope for further decreases in bond yields (or increases in bond prices) as the market moves to fully price in a recession.

We estimate that around 400-500bps of rate cuts are required to drive a recovery in the case of recession. Bond yields are currently discounting 50bps of cuts. There is scope for further decreases in bond yields (or increases in bond prices) as the market moves to fully price in a recession.

Is this a sentiment and momentum driven price action?

The rapid and violent price action in Q4 2018 pushed market sentiment sharply lower. Sentiment improved sharply in Q1 2019. This reflected several improvements, including:

- The pivot towards fewer rate hikes from the US Fed

- Expectations for a positive outcome in US-China trade negotiations

- Stabilizing economic data in China

During Q4 2018, speculative positioning became very net short across many key assets, including the S&P500 (Fig 5). That reversed in Q1 2019. We think that helped push the broad market index higher.

Fig 5: Speculative net positioning become very long the S&P500

Which asset will give us the best risk-adjusted returns over the medium-term?

Our investment process compares prospective risk-adjusted returns across asset classes. We then allocate to those that offer the best risk-adjusted returns. The recent equity market rally has bought forward returns from the future. The result is that prospective risk-adjusted returns are low relative to history. We also expect average annualized returns to be low in an absolute sense, given our forecast for recession. In contrast, we think bond yields are not yet fully discounting a recessionary outlook. In this scenario, we expect central banks around the world, including Australia and the US, will conduct quantitative easing. Risk-adjusted returns look reasonable despite the relatively low yields on offer currently. One of the outcomes from our investment process is that we avoid trying to pick tops and bottoms in the market. Instead we aim to allocate to assets that look undervalued relative to our view of fair value. Our overweight to China at the end of 2018 and through Q1 2019 is an example. On the other hand, we allocate away from assets that look overvalued relative to our view of fair value. Our move to underweight equities in late-March is an example.

Conclusion

Sticking to our processes means we avoid the regret of being out of the market during a rally and the temptation of chasing a rally that has already happened. Right now, sticking to our process means that we think:

- Fundamentals have not changed materially. Recent data reinforces our base case of a recession in the medium term.

- Market pricing (with the recent price rally) does not reflect the underlying fundamentals.

- Sentiment and momentum driven price action are key drivers of the recent equity rally.

- Our clear, repeatable process will deliver the best risk-adjusted returns over the medium-term.

Contact Oreana Financial Services or your affiliated investment advisor to find out how we can assist with managing your wealth.

Data sources: Bloomberg LP, Oreana Financial Services

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).