Search posts

2020 Vision

Clearer from a distance?

The end of January serves as a stark reminder that one year is both a long and a short time in financial markets. Risks can emerge that are unforecastable. Volatility can increase unexpectedly as a result. A broad consensus can be suddenly whipsawed. The impact on portfolio outcomes can be dramatic. We think the intellectual effort spent on making one-year forecasts and outlooks is largely wasted. Fig 1 shows they tend to be wrong – and sometimes by a lot!

Fig 1: One-year forecasts tend to be wrong despite the intellectual effort put into them

2019 ended with risk assets surging. The broad consensus was that equities could continue to rally despite valuations looking stretched. Following a shake-out, the consensus is that market valuations were stretched and vulnerable to bad news. Neither of those consensus observations are particularly useful. Meaningful investment decisions should be based on a longer outlook. We focus on a five-year time period. We try to identify key themes that we expect will matter for investors – and use those themes to build resilient portfolios.

2019 ended with risk assets surging. The broad consensus was that equities could continue to rally despite valuations looking stretched. Following a shake-out, the consensus is that market valuations were stretched and vulnerable to bad news. Neither of those consensus observations are particularly useful. Meaningful investment decisions should be based on a longer outlook. We focus on a five-year time period. We try to identify key themes that we expect will matter for investors – and use those themes to build resilient portfolios.

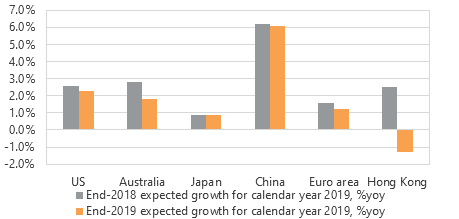

Key Economic Themes

Global economic growth will likely be below trend. US economic growth has been around trend for most of the past decade. But growth has trended lower and leading indicators point to further weakness. We expect global growth to slide below potential over the medium-term. The US faces risks from external shocks, policy error and excess leverage. Credit quality has deteriorated in the era of low rates. The US credit impulse has slowed despite monetary policy stimulus. The Fed is reluctant to cut rates further. Geopolitical risk is elevated. These are all significant risks in the medium-term. Central banks have cut rates in 2019 and further policy stimulus is constrained. The ability of global central banks to cut rates and support growth is limited (Fig 2). With limited ability to cut rates it remains probable that a global recession will occur over the next 24 months.

Fig 2: Central bank policy rates are low relative to the past decade, with limited scope to cut further

Risk assets have rallied as central banks have provided ample liquidity. That leaves many assets vulnerable to corrections over the next five years.

Risk assets have rallied as central banks have provided ample liquidity. That leaves many assets vulnerable to corrections over the next five years.

Actions for investors

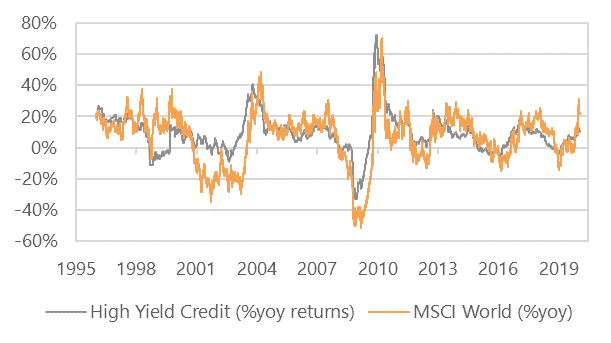

The economic outlook is uncertain. But we think risks are skewed to the downside over the next five years. Investors should look to build resilient portfolios. A resilient portfolio is one that still captures upside but protects against the significant downside risks. In our soon to be published 2020 Medium-Term Global Outlook we suggest several actions for investors. These are summarized below. 1. Commit to improving diversification: Diversification is always important. We observe that many portfolios would benefit from reducing overall portfolio exposure to equities. Current valuations look stretched and medium-term economic risk looks tilted to the downside. A reduced allocation to equities could improve portfolio resilience without compromising the probability of achieving investment objectives. 2. Identify and manage portfolio risks: Risk should be identified and only accepted if it will be rewarded. Portfolio resilience can be achieved by improving portfolio certainty and maintaining returns. We suggest using liquidity management and scenario testing to manage exposures to unrewarded risks. 3. Use dynamic asset allocation to create value: Dynamic asset allocation can be used to either reduce risk or add return. Right now, with many asset valuations looking stretched and risks skewed to the downside, there are many dynamic recommendations that could benefit risk and return. For example, we recommend focusing on higher quality fixed income including sovereign debt to improve portfolio resilience (Fig 3).

Fig 3: Focus on quality – lower quality bonds tend to behave like equities in downturns

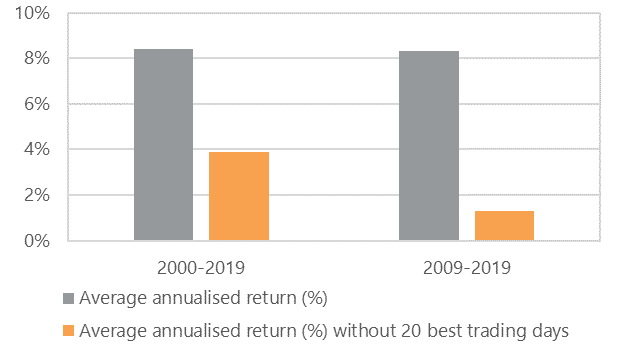

4. Reconsider manager selection: We expect returns to be low on average over the medium-term. This is driven in part by the reality of lower cash returns. In a low return environment, a manager’s alpha generation could be a relatively more important feature of achieving portfolio resilience. 5. Remain invested: Despite our cautious outlook, we recommend investors remain invested. We advocate a long-term investing horizon. There is a significant cost to being out of the market. Missing the 20 best performing days in the ASX200 over the past 10 and 20 years reduces returns annual returns dramatically (See Fig 4). We recommend remaining invested to improve resilience over the longer-term.

4. Reconsider manager selection: We expect returns to be low on average over the medium-term. This is driven in part by the reality of lower cash returns. In a low return environment, a manager’s alpha generation could be a relatively more important feature of achieving portfolio resilience. 5. Remain invested: Despite our cautious outlook, we recommend investors remain invested. We advocate a long-term investing horizon. There is a significant cost to being out of the market. Missing the 20 best performing days in the ASX200 over the past 10 and 20 years reduces returns annual returns dramatically (See Fig 4). We recommend remaining invested to improve resilience over the longer-term.

Fig 4: Average ASX200 returns are much lower if you miss the top 20 trading days

In closing

Our focus on the medium-term over the near-term means that we spend less time on trying to forecast short-term outcomes. Instead, we have looked out over the coming five years to identify key focus areas that we expect will improve portfolio resilience and reduce the risk of negative surprises for investors. Taking a five-year outlook does not mean we ignore near-term risks – both upside and downside. We remain vigilant. We monitor developments monthly. But the start of each year is a useful time to reflect on material improvements to portfolio settings that could improve resilience over the next five years. Implementing these actions is not simple. It requires significant time, expertise and scale. Many require well tested, repeatable processes. A comprehensive governance framework is necessary to implement all of these recommendations well. But the benefit to investors’ portfolios could be transformative through the next five years. The above is a summary of Oreana’s 2020 Medium-Term Global Outlook. Please contact Oreana Financial Services or your affiliated financial advisor to find out how we can assist with managing the risks to your portfolio.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).