Search posts

A V-Shaped recovery is yesterday’s news

Global equity markets fell through March. Economies have shut down. Tens of millions of jobs have been lost. Covid-19 is having an unforecastable impact on global growth. Governments and central banks have introduced support packages. More will be needed. As we continue to update our scenarios, one thing stands out. A V-Shape Recovery is looking less likely.

The outlook is radically uncertain.

Radical uncertainty means that we don’t have a clear idea of the medium-term outlook. We don’t know what will happen to economic growth. We don’t know how that will translate to corporate earnings. It is unclear how dividends and share buybacks will be treated. Investors need a framework to help with this uncertainty. Otherwise any investment action is basically a gamble.

Scenario analysis can help.

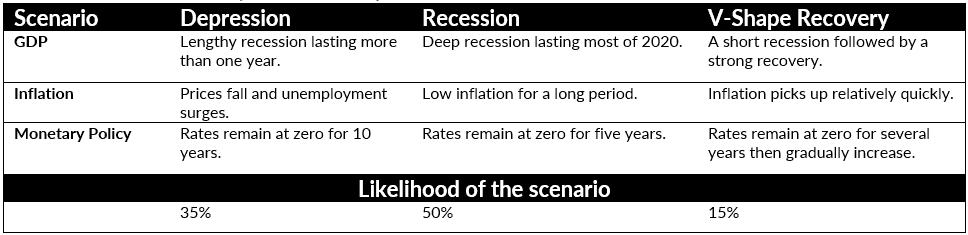

We use scenario analysis to help inform our investment decisions. We identify three plausible scenarios. These scenarios are then run through our regular models. We analyse the risks. We identify opportunities. And we make thoughtful, researched decisions to maintain resilient portfolios. Our scenarios are summarised in Table 1.

Table 1: Our scenarios help us frame the possible outlook.

All our scenarios include a recession.

The world is already in recession. We don’t yet know how deep the recession will be. We don’t know how long it will last. But our process has identified some signposts that we can use to update the likelihood of each scenario. These are set out below.

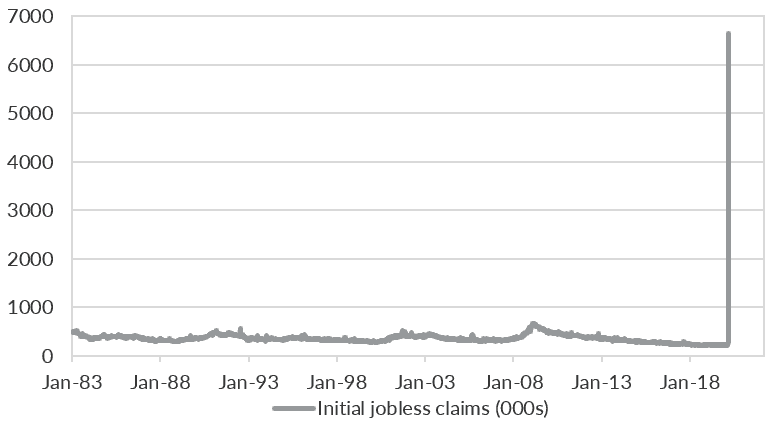

1. US jobless claims.

US initial jobless claims have surged. This is the timeliest data we have on the state of the US labour market. The unemployment rate will be breathtaking in its rapid increase. And jobs will be slower to recover than most expect. This isn’t going to be V-Shaped.

US initial jobless claims have surged. This is the timeliest data we have on the state of the US labour market. The unemployment rate will be breathtaking in its rapid increase. And jobs will be slower to recover than most expect. This isn’t going to be V-Shaped.

2. US Earnings.

US earnings growth stalled in 2019. It will collapse in H1 2020. Analysts’ expectations remain too high relative to what is coming down the pipeline. When earnings reporting season begins in earnest in a week, there is scope for a brutal repricing of the likelihood of a deep earnings recession.

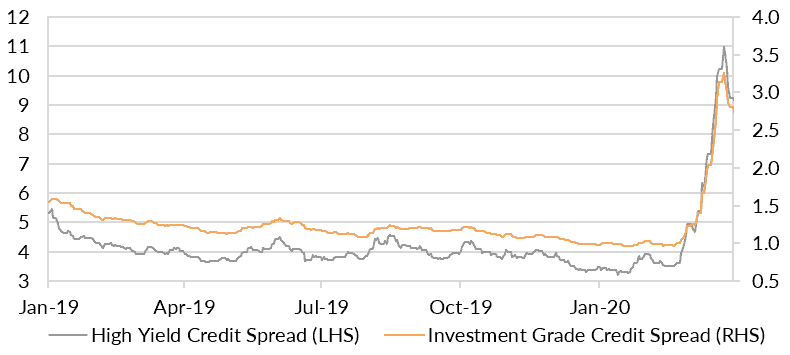

3. Sub-investment grade credit spreads.

Sub-investment grade spreads have widened rapidly. The Fed’s moves to buy investment grade credit helped the sub-investment grade sector find some liquidity too. But rating agencies are downgrading companies at a record pace. We are monitoring downgrades and defaults and we are worried that worse is yet to come.

Sub-investment grade spreads have widened rapidly. The Fed’s moves to buy investment grade credit helped the sub-investment grade sector find some liquidity too. But rating agencies are downgrading companies at a record pace. We are monitoring downgrades and defaults and we are worried that worse is yet to come.

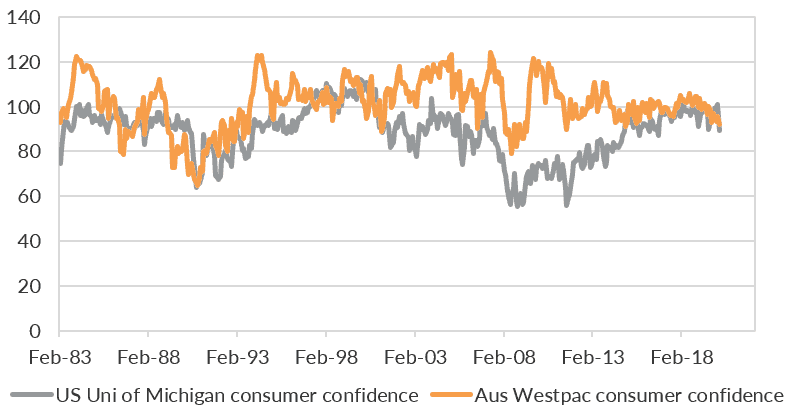

4. Consumer sentiment.

The consumer sector was the saviour of the US economy in 2019. That won’t be the case in 2020. Job losses and economic uncertainty has crushed consumer sentiment. We will continue to monitor the impact on consumer spending.

The consumer sector was the saviour of the US economy in 2019. That won’t be the case in 2020. Job losses and economic uncertainty has crushed consumer sentiment. We will continue to monitor the impact on consumer spending.

A V-Shape Recovery is looking less likely.

Two weeks ago, we had an equal likelihood for our three scenarios. We have updated those probabilities in Table 1. The collapse in US jobs, the inadequate fiscal support, and the unfounded earnings optimism suggests the Recession scenario is more likely than a V-Shaped Recovery. In contrast, we think markets are still pricing a high likelihood of a V-Shaped Recovery.

Stick to your process. Rely on good governance. And focus on resilience.

Periods of radical uncertainty throw up great opportunities for investors. But these periods are also times when a lot of value can be lost. Achieving great outcomes will require a clear investment process. Strong investment governance. An ability to look through the noise and resist making knee-jerk reactions. As always, we recommend a focus on building and maintaining resilient portfolios. And for now, don’t hold your breath for a V-Shaped Recovery. Reach out Oreana Financial Services to find out how we can assist with managing your investment challenges in this period of uncertainty.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).