Search posts

Are the wheels of recovery in motion?

In search of a gentle turning point in the global economy

Through much of early 2019, global bond markets and economic data were pointing to risk of a global slowdown. In early October, market sentiment turned positive after a potential Phase One trade deal was announced between the US and China. Since then, market commentators have been looking for signs of a gentle turning point in the global economy. This is important. Equity markets have priced in strong earnings and recovering growth. Bond markets have discounted fewer rate cuts in the US. The economy will need to show signs of improving to support these moves. The risk is that markets are focusing on the noise around a potential trade deal, not the underlying fundamental signal. And that signal continues to point to downside risk.

Global growth is slowing

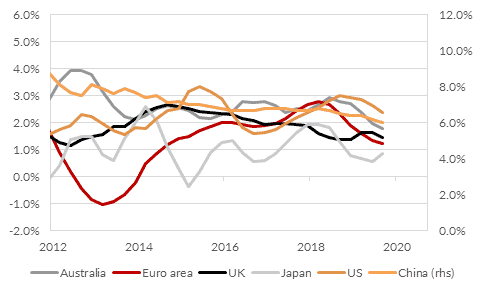

GDP growth in most major economies peaked sometime in mid-2018 (Fig 1). Since then the trend has been slower. For the US, growth is now around trend. For others, including Australia, growth is well below trend.

Fig 1: Global GDP growth (yoy%) has been slowing across most major economies

Industrial recession pre-dates trade uncertainty

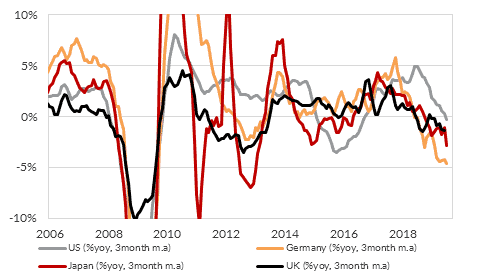

An important part of slowing growth has been a broad-based manufacturing and industrial recession. Fig 2 shows industrial production is shrinking. And growth has been slowing since late-2017 – before the trade dispute intensified. Negative growth rates did stabilize briefly, but the most recent data show a worrying trend lower.

Fig 2: Global industrial production is shrinking

Households to the rescue?

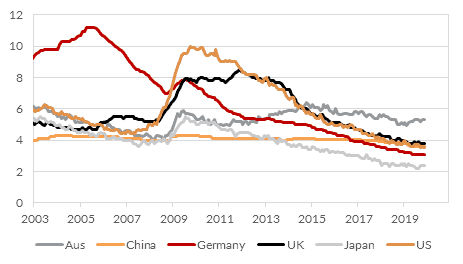

It is not all bad news. The labour market in many countries remains resilient. The US has reached a record low unemployment rate (Fig 3). Jobs growth is slowing – but that is to be expected as an economy slows to trend. The US consumer remains in reasonable shape – and has been the key supporter of US economic resilience.

Fig 3: Developed market unemployment has moved lower

What should we look out for?

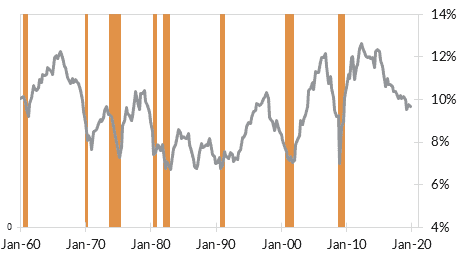

Historically recessions in the US have been preceded by three important conditions. They are:

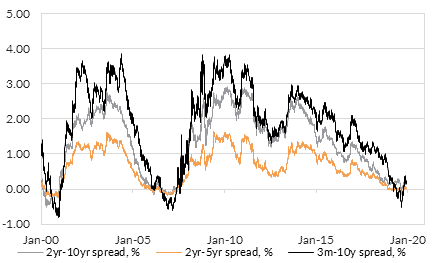

1) An inverted yield curve

2) Falling profit share of GDP

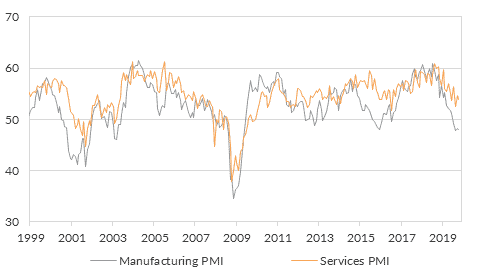

3) Manufacturing and services PMIs falling below 50

So far, two and a half of the three conditions have been satisfied. The yield curve – the difference between longer-dated and shorter dated yields in the US – did invert this year. Historically a recession has followed shortly after every yield curve inversion. Profit share of GDP has been shrinking consistently since 2014. Corporate ability to extract profit from incomes is decreasing. And the manufacturing PMI in the US has been below 50 since August 2019. The US is in a manufacturing recession already. The one indicator left is the services PMI. It has been holding above 50 despite trending lower since November 2018. Services are a dominant part of the US economy. But growth is slowing.

So far, two and a half of the three conditions have been satisfied. The yield curve – the difference between longer-dated and shorter dated yields in the US – did invert this year. Historically a recession has followed shortly after every yield curve inversion. Profit share of GDP has been shrinking consistently since 2014. Corporate ability to extract profit from incomes is decreasing. And the manufacturing PMI in the US has been below 50 since August 2019. The US is in a manufacturing recession already. The one indicator left is the services PMI. It has been holding above 50 despite trending lower since November 2018. Services are a dominant part of the US economy. But growth is slowing.

Is the economy recovering?

The US economy is big. It turns slowly. Right now, it is still slowing. It is the services sector – the largest part of the economy – that is preventing it from slowing significantly. Slowing growth, trade uncertainty and monetary policy constrained by the Fed’s desire to keep rates steady is likely to prevent a meaningful pick-up in economic growth next year. Still, a gentle turning point is possible. US economic growth could steady at or below trend. We think that is less likely than a recessionary outcome given the signals coming from yields, profits and PMIs. And given those risks are skewed to the downside, we think it is sensible to prepare investment portfolios for a volatile outlook in 2020. Please contact Oreana Financial Services or your affiliated financial Advisor to find out how we can assist with managing the risks to your portfolio. Data sources: Bloomberg LP, Australian Bureau of Statistics

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).