Search posts

Beware the sudden stop

Recession risk and what to do about it

I recently said in the media that I think it likely that Australia will enter a recession in 2020. Recessions are rare. The path to recession is often non-linear. It starts slow. Warning signs are visible without an immediate threat. Central banks tend to implement gradual support. But then a tipping point occurs. This could be from a sudden shock, a crack in a market that was prone to excess, or failure to cut rates enough. Now the economy that was gradually slowing is falling rapidly into recession. To use a famous adage from a seminal paper[1] – “It is not speed that kills, it is the sudden stop”.

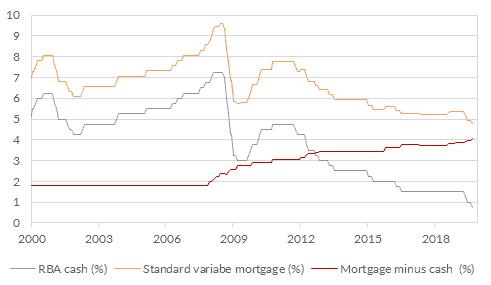

Figure 1: RBA rate cuts have less impact

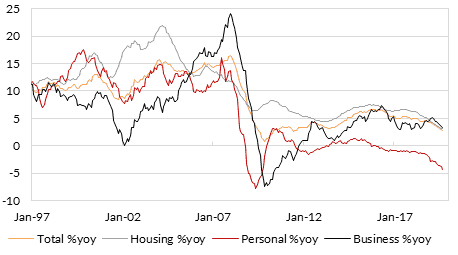

The RBA has cut rates from 1.50% to 0.75% in a matter of months. Australia’s commercial banks have not passed 100% of RBA rate cuts onto borrowers for more than a decade. The last three cuts have seen about 50% passed on to borrowers. The widening gap between RBA cash and mortgage rates has dampened the impact of the monetary policy transmission mechanism in Australia. It shows in credit outstanding. Growth of credit outstanding has been trending lower for around the last four years (Fig 2). This is true in personal, housing and business credit. Rate cuts have not stimulated growth. In economics, we call this impotence of central banks at the limits of monetary policy “pushing on a string”. This impotence is one of the reasons why we have been expecting the RBA to implement QE since February this year.

The RBA has cut rates from 1.50% to 0.75% in a matter of months. Australia’s commercial banks have not passed 100% of RBA rate cuts onto borrowers for more than a decade. The last three cuts have seen about 50% passed on to borrowers. The widening gap between RBA cash and mortgage rates has dampened the impact of the monetary policy transmission mechanism in Australia. It shows in credit outstanding. Growth of credit outstanding has been trending lower for around the last four years (Fig 2). This is true in personal, housing and business credit. Rate cuts have not stimulated growth. In economics, we call this impotence of central banks at the limits of monetary policy “pushing on a string”. This impotence is one of the reasons why we have been expecting the RBA to implement QE since February this year.

Figure 2: Credit growth has trended lower for the past four years

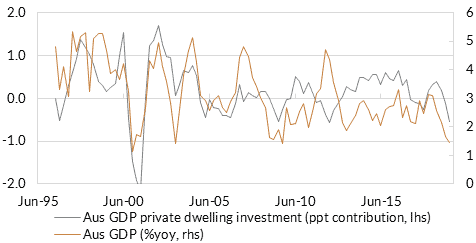

The RBA rate cuts have had some impact. House prices have increased from their troughs and some of the higher frequency housing data indicate improved conditions. But dwelling construction is stuck in a rut. Private dwelling investment is in contraction – although it is not the driver of GDP growth that it used to be (Fig 3).

The RBA rate cuts have had some impact. House prices have increased from their troughs and some of the higher frequency housing data indicate improved conditions. But dwelling construction is stuck in a rut. Private dwelling investment is in contraction – although it is not the driver of GDP growth that it used to be (Fig 3).

Fig 3: Dwelling investment has contracted considerably

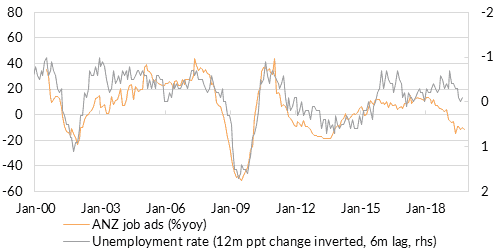

The household sector isn’t doing so well either. Jobs and wages growth are slow. Unemployment is rising. We suspect unemployment could increase as much as 0.5ppt over the next six months. We are watching several indicators for this, but ANZ job ads remains one of the better leading indicators (Fig 4).

The household sector isn’t doing so well either. Jobs and wages growth are slow. Unemployment is rising. We suspect unemployment could increase as much as 0.5ppt over the next six months. We are watching several indicators for this, but ANZ job ads remains one of the better leading indicators (Fig 4).

Figure 4: The collapse in ANZ job ads could lead the unemployment rate higher

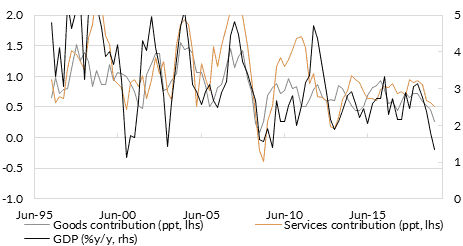

With less dwelling construction, lower wage growth and slowing jobs, it is unsurprising that the household sector spending contribution to GDP growth is well below the long-run average (Figure 5).

With less dwelling construction, lower wage growth and slowing jobs, it is unsurprising that the household sector spending contribution to GDP growth is well below the long-run average (Figure 5).

Figure 5: Household spending is contributing less to GDP compared to history

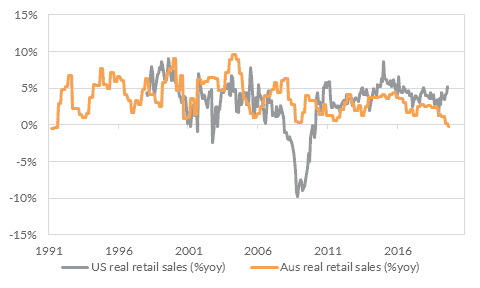

This leaves Australia’s economy in a very different position to the US. In the US, the consumer has ridden to the rescue (Fig 6). Retail sales in the US have rebounded. This potentially reflects some front-loaded spending ahead of tariff increases. In Australia, retail sales volumes have contracted compared with a year earlier for the first time since the recession in the 1990s.

This leaves Australia’s economy in a very different position to the US. In the US, the consumer has ridden to the rescue (Fig 6). Retail sales in the US have rebounded. This potentially reflects some front-loaded spending ahead of tariff increases. In Australia, retail sales volumes have contracted compared with a year earlier for the first time since the recession in the 1990s.

Figure 6: Australian retail sales volumes contract for the first time since the last recession

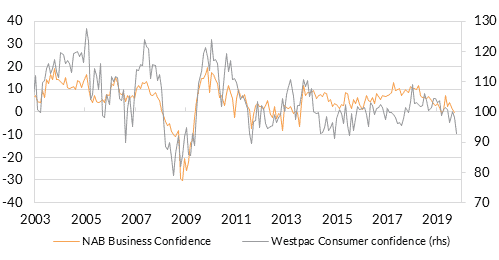

In recent RBA communication, the Bank has spoken about the risk of further rate cuts doing more harm than good. This is called the reversal rate – the point at which central bank rate cuts do more harm than good. Recent consumer and business confidence declines suggest we’re probably close to it now (Fig 7).

In recent RBA communication, the Bank has spoken about the risk of further rate cuts doing more harm than good. This is called the reversal rate – the point at which central bank rate cuts do more harm than good. Recent consumer and business confidence declines suggest we’re probably close to it now (Fig 7).

Figure 7: RBA rate cuts have failed to boost consumer and business sentiment

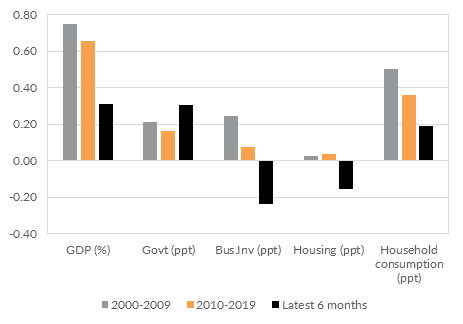

None of the above guarantees a recession. But there are a lot of warning signals. And they have been slowly building over time. The RBA has seen it. Perhaps the Government has seen it – after all, without above-average government spending Australia would likely be in recession already (Fig 8). The bond market has been warning of it. But equity markets remain near historic highs.

None of the above guarantees a recession. But there are a lot of warning signals. And they have been slowly building over time. The RBA has seen it. Perhaps the Government has seen it – after all, without above-average government spending Australia would likely be in recession already (Fig 8). The bond market has been warning of it. But equity markets remain near historic highs.

Figure 8: Growth is below average everywhere – but for government spending

What actions can you take? How do you beware the sudden stop? As asset allocators, we have focused on improving our diversification. We have added to defensive positions. We are working with good managers to add alpha against what could be a broad market downturn. But 2020 is fast approaching, and we think the time to act is now. Consult an investment advisor for personalised insights if necessary. Please contact Oreana Financial Services or your affiliated Advisor to find out how we can assist with managing the risks to your portfolio. [1] Dornbusch, Rudiger., Goldfjan, Ilan & Valdes, Rodrigo O. 1995. “Currency Crises and Collapses.” Brookings Papers on Economic Activity 2. Washington: Brookings.

What actions can you take? How do you beware the sudden stop? As asset allocators, we have focused on improving our diversification. We have added to defensive positions. We are working with good managers to add alpha against what could be a broad market downturn. But 2020 is fast approaching, and we think the time to act is now. Consult an investment advisor for personalised insights if necessary. Please contact Oreana Financial Services or your affiliated Advisor to find out how we can assist with managing the risks to your portfolio. [1] Dornbusch, Rudiger., Goldfjan, Ilan & Valdes, Rodrigo O. 1995. “Currency Crises and Collapses.” Brookings Papers on Economic Activity 2. Washington: Brookings.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).