Search posts

Economics, not emotion, when evaluating Hong Kong equities

Don’t wait for the data

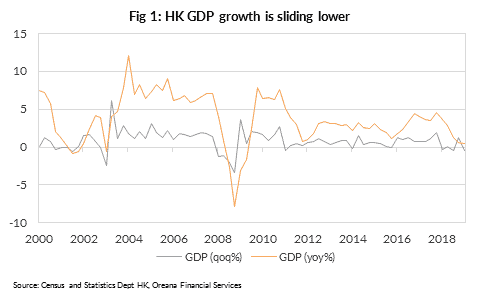

Why wait until the official GDP data are published in October to point out the obvious? Hong Kong is in recession. Tourist arrivals, port traffic, retail sales, property sales and manufacturing have slumped. The unemployment rate is ticking higher. The most recent GDP reading (for Q2 2019) was the third quarter of negative growth in the past five quarters. Two consecutive quarters of negative GDP growth is a rule of thumb, but if you have lived and worked through a recession you know one when you see it.  Financial markets know it too. IPO listings have crashed this year. Two mega-IPOs have shelved. The Hang Seng Index is more than 11% below its peak.

Financial markets know it too. IPO listings have crashed this year. Two mega-IPOs have shelved. The Hang Seng Index is more than 11% below its peak.

Uncertainty is unsettling

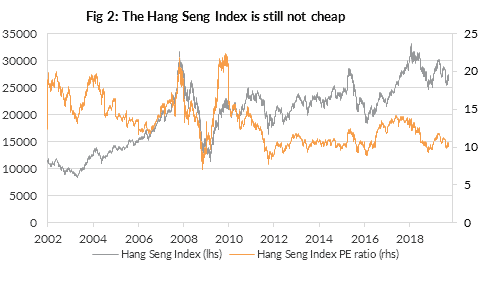

There is a school of thought that HK equities now look cheap with current PE ratios around 10. We disagree. Domestic and international political uncertainty remains elevated. And Hong Kong economic data will get worse before it gets better. The economic outlook is materially worse than it was at the start of this year. We estimate that HK equities remain fundamentally overvalued by more than 13%.

Turbulence is not good for timing

Our philosophy is not to try and time the markets. In the near-term, equity markets get pushed around by emotion, sentiment and flows and we cannot guess where they will go with any accuracy. But right now, the likely returns on offer from HK equities over the medium-term look poor. They have been poor an average anyway – with annualised returns for the Index over the past 10-years at just over 2%. Take away the best 20 trading days, and those returns move to annualised losses of more than 5%.

Prepare, don’t panic

What does this mean for your wealth? How can you maximise the probability you achieve your investment goals during a recession? Now is not the time to try and pick market bottoms. That is too often driven by emotion and that path can lead to wealth destruction. Now is not the time to concentrate on individual asset classes. Instead, now is the time to:

- protect your wealth with sensible asset allocation,

- adopt a truly diversified portfolio with robust risk management, and

- be crystal clear about your investment objectives and risk tolerance.

For all of us living in recession in Hong Kong, now is the time to prepare. Getting the help of a dependable investment advisor will be invaluable working with you and providing insights. Contact Oreana Financial Services or your affiliated Advisor to find out how we can assist with managing your wealth.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).