Search posts

Don’t be fooled by AUD weakness

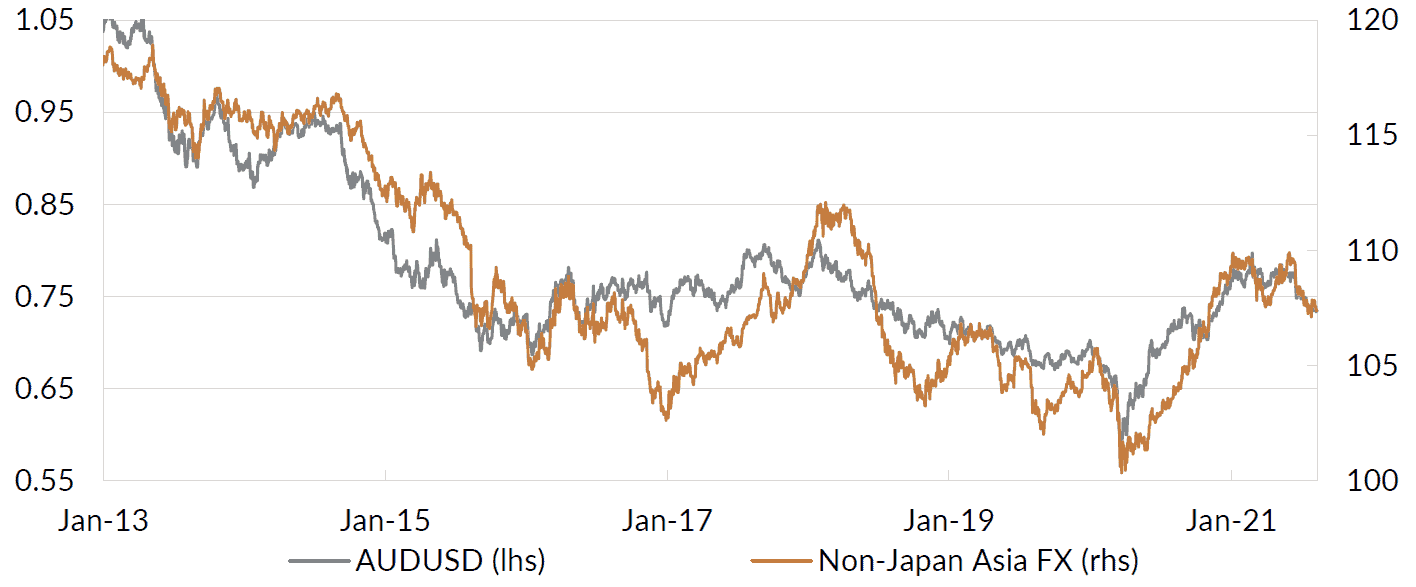

The Australian dollar has depreciated to around USD0.73 from its peak of around USD0.80 earlier this year. That comes after an almighty rally from below USD0.56 in March during the worst of the pandemic (Figure 1).

Figure 1: The AUD has weakened recently following the strong post-pandemic rally.

Weakness in the AUD reflects:

- USD strength: The Covid19 Delta variant has increased concerns that the global economic recovery could falter. That resulted in safe-haven flows to US Treasuries – supporting USD strength.

- Australian economic and political uncertainty: The Covid19 pandemic has been challenging for Australia from an economic and policy perspective. The vaccine rollout has been handled less well than most developed economies, and significant parts of Australia’s population remains under lockdown.

- Concerns about Asian growth: Asia has had a slow rollout of Covid19 vaccines that is restricting its recovery relative to the developed world. That has depressed Asian currencies. The AUD remains a proxy for accessing Asian FX (Figure 1), which has contributed to weakness in the AUD.

We expect the AUD weakness will not persist. This contrasts with the forwards market, where interest rate differentials are indicating the AUD will remain flat around current spot levels for the foreseeable future.

We expect the AUD will recover over the coming 18 months.

This strength will be driven by:

- Ongoing global recovery: The global recovery has been delayed, but not derailed, by the Covid 19 Delta variant. The US economic data show that the world’s largest economy is recovering well. Further reopening is yet to come. And fiscal stimulus remains a feature of the near-term landscape. Global growth will benefit the AUD.

- Australian reopening: Australia’s recovery has been remarkable, given the pitfalls along the vaccine rollout. 2022 is likely to be a year of exceptional growth, given the pent-up demand from extended lockdowns. We expect that will allow Australian government bond yields to drift higher, adding pressure to the AUD.

- Vaccination rollout in Asia: Asia’s economic recovery has been marred by a lack of vaccines. 2022 and 2023 may be a period of relative strength compared with the developed world, where the recovery is more mature. This should support Asian currencies and the AUD.

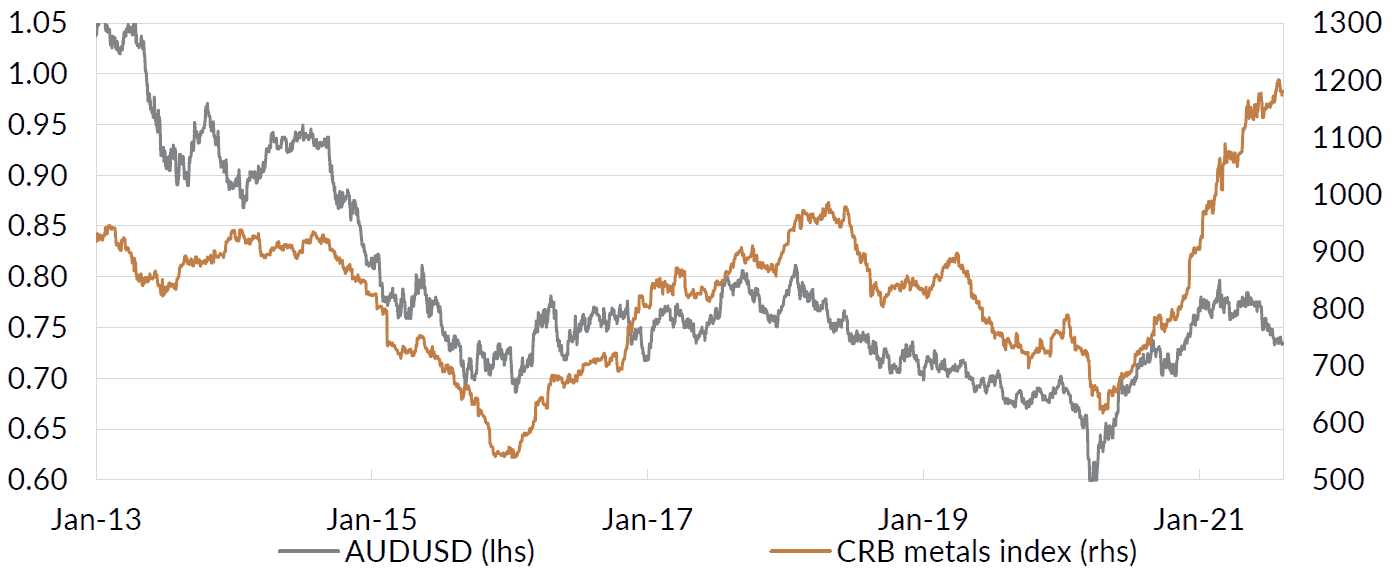

- Solid commodity prices: The AUD is a commodity currency. Recent AUD weakness is at odds with commodity price strength (Figure 2). We expect the improvement in Australia’s terms of trade as a result of strong commodity prices to support the AUD over the coming 18 months.

- Risk-on sentiment: We anticipate the reversal of safe-haven and speculative flows into the USD will be a positive for the AUD in the near-term, particularly over H1 2022.

Figure 2: The AUD weakness is at odds with commodity price gains.

Currencies matter for Australian investors in international assets. That becomes even more important with interest rates at record lows. The AUD may also be an important source of returns for international investors in Australian assets.

Contact PAS for more information

The Portfolio Advisory Service has been working with clients across Australia and Asia to help manage investment solutions. Our work is supported by deep asset class research and manager review expertise within the team.

Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).