Search posts

Getting real with valuations

The economic outlook is positive but remains fragile. A gradual economic recovery has kicked in. Manufacturing and services sector activity is being helped by economic reopening. Jobs are being recovered. There are risks. The US Congress is struggling to approve further fiscal stimulus. US and Chinese political tensions are escalating. But against this backdrop, gold and equity prices have continued to rally. Is this sustainable and what are the implications?

Real yields matter.

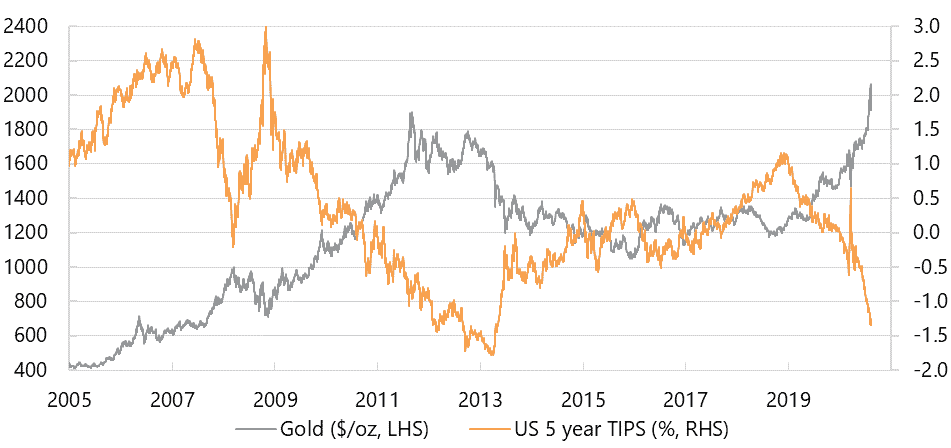

US Treasury real yields (the yield on a US Treasury bond that is adjusted for inflation) are at or near all-time lows.

Chart 1: US real yields have moved towards all time low levels

This reflects a combination of:

This reflects a combination of:

- Uncertainty about real economic growth. Investors would prefer to take the certainty of a negative real return from US Treasuries than invest in the real economy with uncertain returns.

- Fed policy commitment. The US Fed has committed to low rates for a very extended period. The Federal Funds rate may remain at 0.25% for as long as the next decade. That has compressed term premium and capped nominal Treasury yields.

- Inflation expectations increasing. The Fed’s aggressive monetary policy support, government fiscal support and a gradual recovery has increased the inflationary outlook. With nominal yields capped, real yields have moved lower.

We think these drivers may persist for some time. And low real yields will have implications for investors across a range of assets. In this note, we focus on gold and equities.

Be wary of gold.

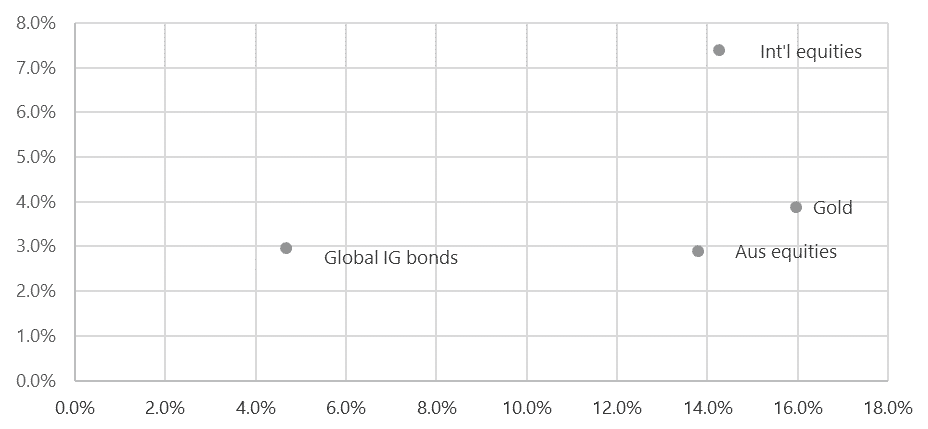

The gold price reached a record high price in August (Chart 3). In our view, gold is a speculative asset. It does not have a stream of income attached to it. It is challenging to derive a fair value. But the precious metal price has been supported by:

- A weaker US dollar. Gold is priced in US dollars and the weaker currency will support gold prices.

- Low real yields. Negative real yields make gold’s zero income stream relatively more attractive.

- Rising inflation expectations. Inflation expectations have increased due to the economic recovery and the Fed’s aggressive monetary policy.

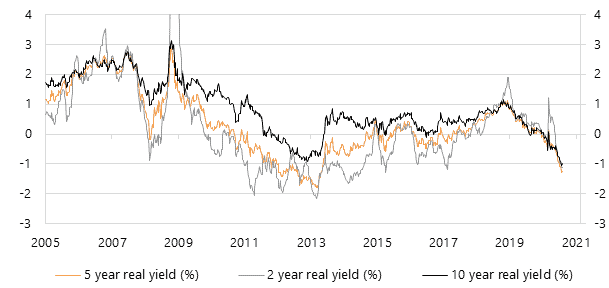

In our view, gold is not a great diversifier or inflation hedge for a portfolio. It has equity-like volatility, bond-like returns (Chart 2), positive correlation to global equities and a small (2.5%-5% allocation) will not have a material positive impact on risk-adjusted returns to most well-diversified portfolios.

Chart 2: Gold is equity-like risk and bond-like returns.

Right now, we think investing in gold at these price levels requires conviction not only that real yields will remain negative, but that they will continue to fall as they did after late-2010 (Chart 3). It is the rate of change in real yields that matters for the gold price. And given we are at or near record low real yields, that would be a bold prediction.

Right now, we think investing in gold at these price levels requires conviction not only that real yields will remain negative, but that they will continue to fall as they did after late-2010 (Chart 3). It is the rate of change in real yields that matters for the gold price. And given we are at or near record low real yields, that would be a bold prediction.

Chart 3: Gold has moved higher as real yields have pushed lower.

Continued support for equities.

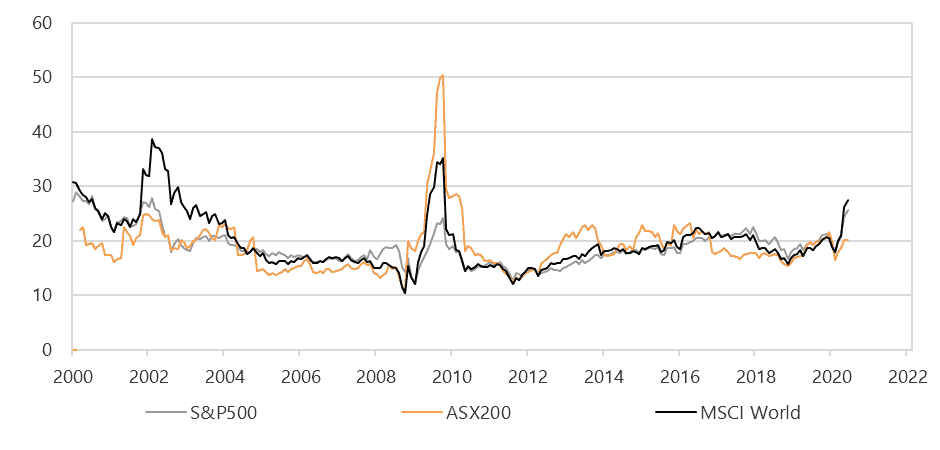

Broad equity indices have recovered from their lows in March. Earnings collapsed as lockdowns persisted, leaving price-earnings ratios to surge higher (Chart 4).

Chart 4: PE ratios have surged as prices have rallied in Q2.

We think the surge in prices reflects:

We think the surge in prices reflects:

- Central bank action. Central banks globally have cut rates to low if not negative levels. And asset purchase programmes have added liquidity in financial markets. A lower discount rate has increased the current fair value of equities and excess cash looking for yield has exacerbated that impact.

- Corporate buybacks. The impact of low real yields and an uncertain return from reinvesting cash leaves issuing cheap debt and buying back equity an attractive option for corporate treasurers.

- Economic recovery. The gradual global economy is recovery is progressing. Economies are exiting lockdown. The world economic is probably not going to have another recession over the next five years. The recovery and continued growth are a tailwind for the corporate earnings outlook.

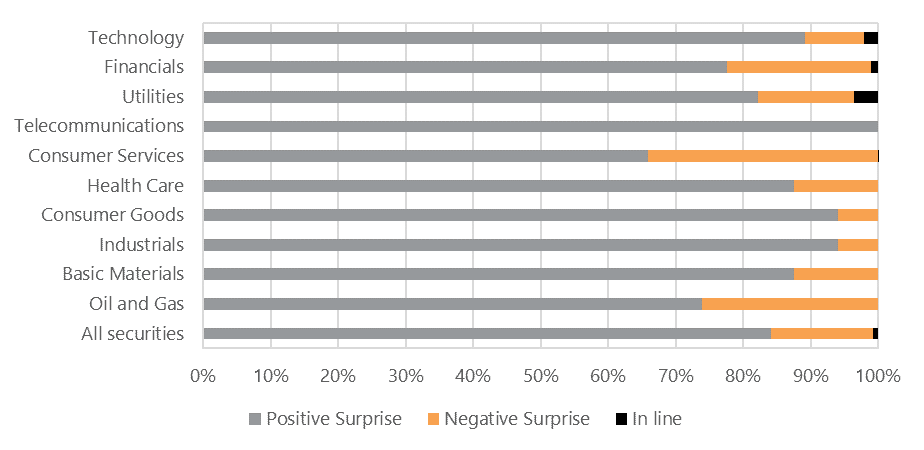

Earnings have surprised on the upside in the recent US earnings reporting season (Chart 5). We expect a similar outcome in Australia over coming quarters. We think that will coincide with PE ratio compression, bringing equity valuations back towards historic norms even as prices continue to rally.

Chart 5: US earnings reporting season has seen mostly positive surprises.

There are risks. Historically we have observed a steepening of the US Treasury yield curve (the difference between 10-year and 2-year yields) as the world comes out of recession. The Fed has repressed that steepening with its policy settings. Until that curve begins to steepen, we expect financial and cyclical value exposures may struggle to outperform.

There are risks. Historically we have observed a steepening of the US Treasury yield curve (the difference between 10-year and 2-year yields) as the world comes out of recession. The Fed has repressed that steepening with its policy settings. Until that curve begins to steepen, we expect financial and cyclical value exposures may struggle to outperform.

What does this mean for my portfolio?

Big macroeconomic themes can at times overwhelm asset specific risks. We think that is happening with negative US real yield right now. To a large extent, returns for gold and value or cyclical equity exposures will be driven by the real yield outlook. We suggest caution both in adding gold exposure, and in dialling back exposure to equity value factors. Getting in touch and working with a professional investment advisor can prove to be invaluable. Our monthly Asset Allocation Review considers a range of asset returns and outlooks over the medium-term. Reach out to our Portfolio Advisory Service to find out how we can assist you with managing the upcoming investment challenges. Data Source: Bloomberg LP, Oreana Financial Services

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).