Search posts

Perspectives on cryptocurrency

Cryptocurrencies had a challenging start to May. Terra Luna, a stable coin that had been among the largest market cap currencies, collapsed in May. The currency was pegged to the USD, but rapidly lost the peg to fall to less than $0.001 by 13 May. The collapse has spread through other cryptocurrencies. Bitcoin has shed around 60% of its value from the peak reached in November 2021. Ethereum has similarly seen its price fall around 60%.

In November 2021, we received a flurry of interest from investors asking whether we would approve cryptocurrencies, and whether they should be included in portfolios. At the time, we wrote a Perspectives note that we shared with our clients.

The conclusion of the note is particularly important, given the recent volatility. We said cryptocurrencies are not an “asset” in the sense that we use the word. There are no cash flows that can be discounted back to arrive at a fair value capital. It is volatile, and that presents challenges within a diversified portfolio.

We warned that cryptocurrencies are probably not inflation hedges or downside risk hedges, and instead are very volatile. We thought it was difficult to make a case for including cryptocurrencies in portfolios using our existing portfolios construction framework. Our view was that any allocation should be appropriate risk weighted – and given the very high risk, that weight was likely to be very small.

For this month’s insights, we have reproduced that Perspectives.

November 2021 – PAS Perspectives on Cryptocurrency

Cryptocurrencies are a relatively new technology, but have gained a lot of attention given the eye-popping growth and returns across a range of different currencies.

The market for digital currencies has grown exponentially. But despite the rapid growth, the size of the market remains smaller than global equities, for example, or global fixed interest.

Cryptocurrencies have delivered outsized returns in the decade to 2021. This has been accompanied by outsized volatility. The eyewatering returns has contributed to the growth, and interest, in these currencies.

Cryptocurrencies present challenges for asset allocators. The higher risk needs to be appropriately positioned if it is used in a diversified portfolio, to prevent the currency swamping the risk adjusted return profile of the portfolio.

While we have not allocated to cryptocurrencies within our client portfolios, we do think it is important to understand the crypto landscape. This note provides a starting point for that understanding, and some suggested further reading.

What is cryptocurrency?

Cryptocurrency refers to typically decentralised digital money. Bitcoin, launched in 2008, was the first cryptocurrency and remains the largest and best known. In the years since Bitcoin was launched, other cryptocurrencies have grown as digital alternatives to money issued by governments.

How big is the crypto market?

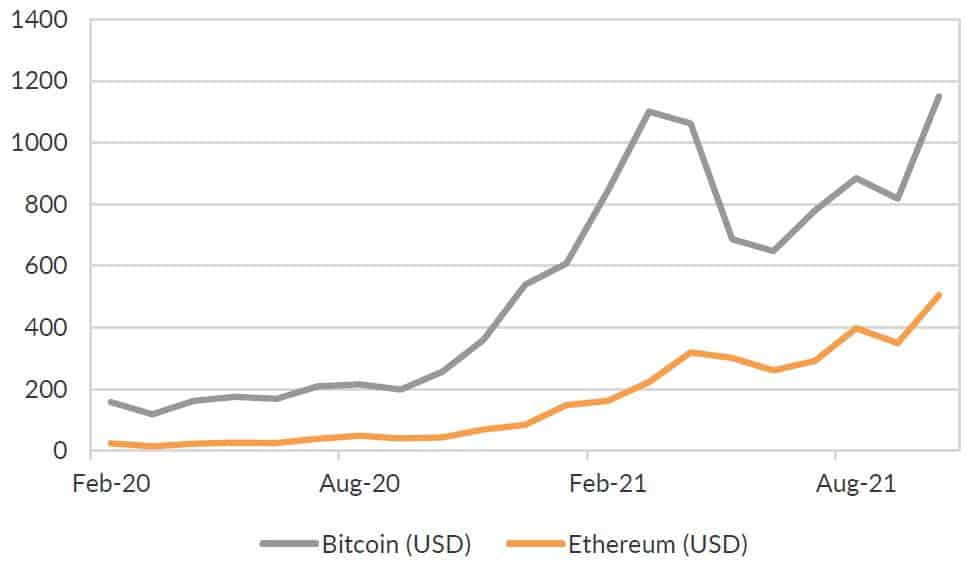

The cryptocurrency markets is big, and it is growing quickly. Chart 1 shows the market capitalisation for outstanding Bitcoin and Ethereum, two of the largest digital currencies. The value outstanding of Bitcoin, for example, has increased from around USD200billion in early 2020 to USD1.2trillion in October 2021. While the growth has been staggering, it remains relatively small compared with the market capitalisation of the S&P500 (US41.5trillion) or the US Treasury market (USD22.8trillion).

Chart 1: Market capitalisation of Bitcoin and Ethereum has surged since 2020.

What has the risk-return experience been?

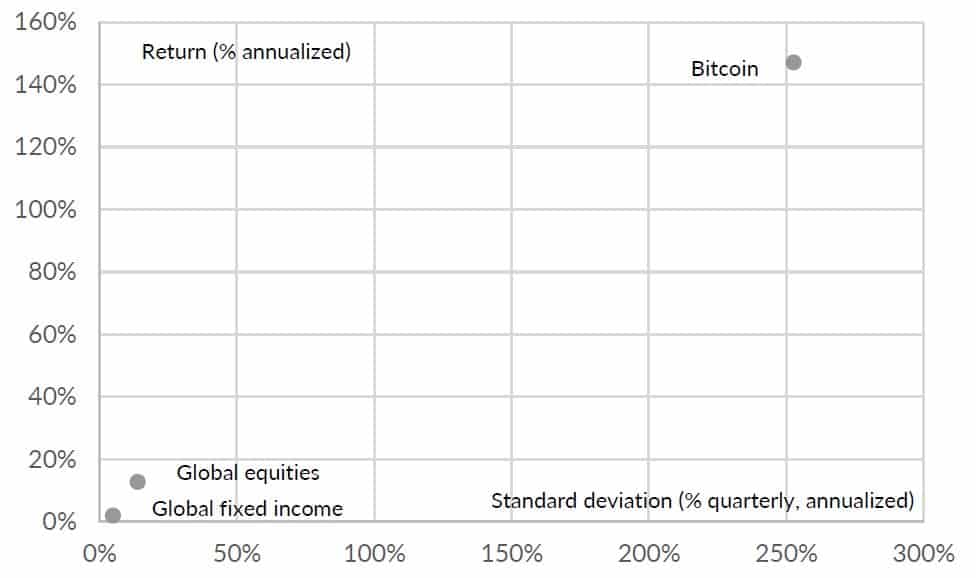

Cryptocurrencies are volatile. The annualised quarterly volatility for Bitcoin over the past decade has been greater than 200%! That compares with around 14% for the MSCI World Index, and around 5% for the Bloomberg Global Aggregate fixed income index.

Returns have also been high for Bitcoin. The annualised compound return over the past decade is in excess of 140%. That compares with around 12% for global equities and 2% for global bonds (see chart 2).

These capital market assumptions are not set in stone. Over time, the risk-return trade off could move to be more like global equities. But it may not. And we only have a short period of historical returns to help with this judgement.

The challenges in building sensible capital market assumptions for cryptocurrencies adds to the challenge for asset allocators who want to include cryptocurrencies in portfolios.

Chart 2: Risk-return outcomes for asset classes, 2011-2021.

How can I use crypto?

Cryptocurrencies are not an “asset” in the sense that we use the word. There are no cash flows that can be discounted back to arrive at a fair value capital. It is a volatile, and that presents challenges within a diversified portfolio.

Cryptocurrencies have been touted as inflation hedges, downside risk hedges, and hedges against a number of other risks. We think it is too soon to be able to take that view with conviction.

It is difficult to make a case for including cryptocurrencies in the portfolios using our existing portfolios construction framework. This does not mean cryptocurrency has no role in any investor’s portfolio. But we do think that any allocation should be appropriately risk weighted. And given the historical risk (standard deviation), that allocation may be relatively small.

Where can I learn more?

There are many websites and courses available to delve deeper into cryptocurrencies and blockchain, the associated technology. The following links share three such sites that we have used. Note that we do not endorse the views of any content on those websites, but we have found them useful in building out our own knowledge.

https://www.coinbase.com/learn

https://crypto.com/university?category=crypto101

https://www.gemini.com/cryptopedia/story/crypto-101

Contact PAS for more information

The Portfolio Advisory Service has been working with clients across Australia and Asia to help manage investment solutions. This includes a clear move towards managed accounts within the Australian and Hong Kong markets, as well as a focus on investment governance and investment process. The Portfolio Advisory Service can help build custom-made investment solutions including managed accounts, or by providing access to our own range of Active Alpha, Active Beta Plus and Active Beta portfolios. Our work is supported by deep asset class research and manager review expertise within the team – delivering great outcomes for our partners.

Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).