Search posts

The risk from low rates

Low sovereign bond yields, at this stage in the economic cycle, are bad. If they continue to fall, it will represent a negative outcome for the economy. Importantly, lower rates in the near-term could constrain the equity bull market. We expect yields will begin to move higher. That will support strong equity market returns. But investors should be aware of the risks to that view.

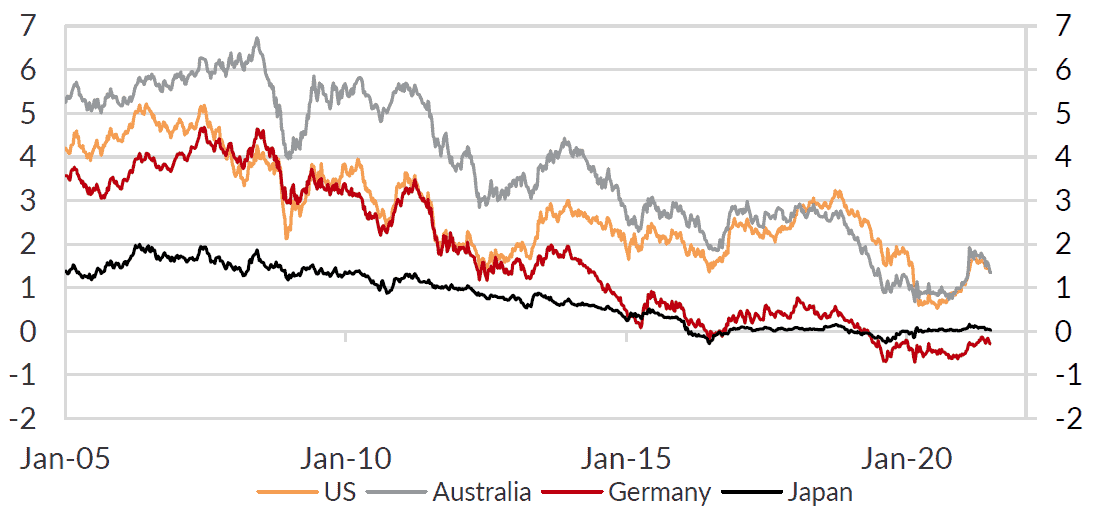

US and Australian 10-year yields have been falling since late-February (Chart 1).

Chart 1: Longer-dated sovereign yields have been declining since February.

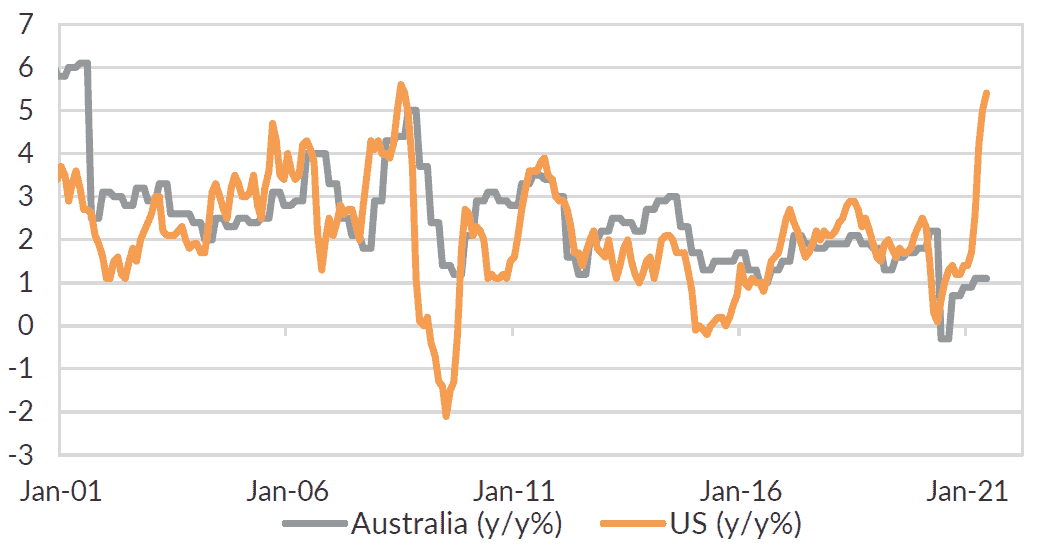

This move lower has been accompanied by rising inflation (Chart 2).

Chart 2: Inflation is moving higher in the US and Australia.

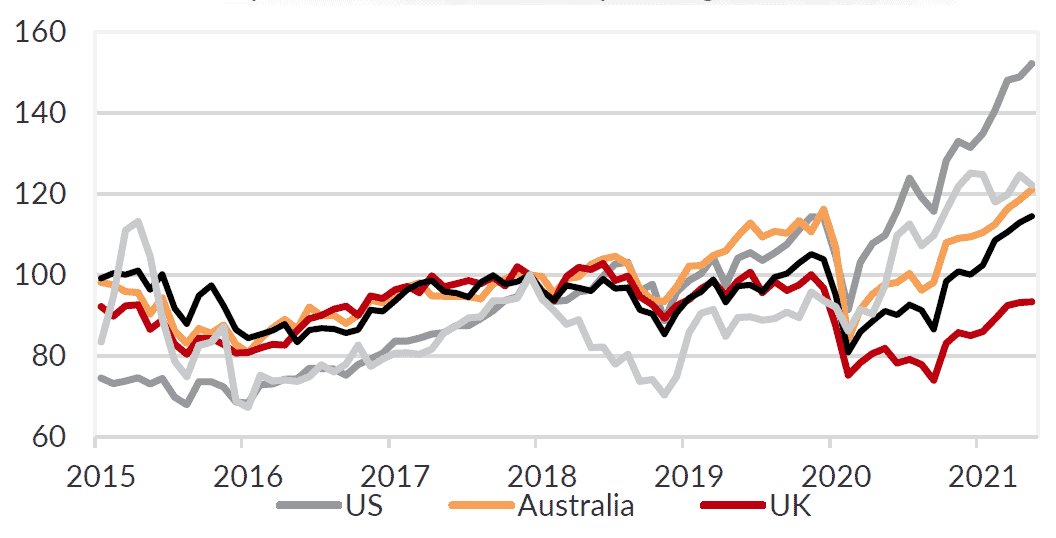

Equities have so far taken the lower yields in their stride (Chart 3). Aside from China, most major equity markets have pushed to fresh cyclical peaks. Lower yields have slowed and, in some cases, reversed the rotation from growth stocks in to more cyclical and value stocks.

Chart 3: Global equities have continued to push higher.

We think lower yields are a major risk to the equity market rally. Nominal yields should be moving higher at this stage of the economic recovery.

That should be led by real (inflation-adjusted) yields. Higher real and nominal yields would reflect a confidence that the economy is recovering. It would reflect capital being allocated from the safest assets to investment in riskier opportunities.

We expect equity markets will deliver solid returns over the medium-term. Lower rates supported equity markets in the very early stages of the pandemic recovery. But now lower rates are simply signalling growth and inflation outlook concerns.

And cross asset movements are showing that. Risk-off and safe haven assets – including the Japanese Yen, the US dollar, US Treasuries and Australian Government bonds – are all performing well.

Risk-on assets – including the Australian dollar – are struggling to deliver further gains.

The coming months will be critical for the US Federal Reserve, the Reserve Bank of Australia, and other central banks to manage expectations for a strong recovery, a reduction in quantitative easing, and a gradual move higher in yields.

Equities will continue to deliver strong returns if that is managed well.

Contact PAS for more information

The Portfolio Advisory Service has been working closely with clients across Australia and Asia to help manage investment solutions and investment governance. Our work is supported by deep asset class research and manager review expertise within the team.

Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).