Search posts

Up, up, and away?

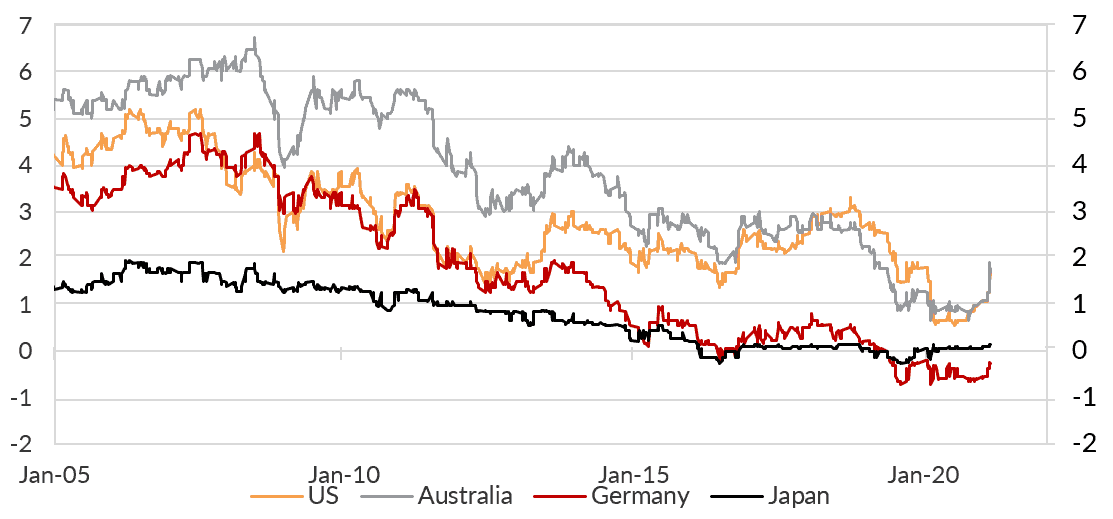

Global sovereign bond yields moved sharply higher over February (Figure 1). Higher sovereign bond yields have reflected expectations about higher inflation but also expectations for better economic growth. The speed of the increase in yields proved a challenge for global growth stocks. We expect higher nominal bond yields will increasingly reflect a better growth outlook, supporting the outlook for global equities.

Figure 1: Global 10-year bond yields have increased recently.

Why is it important?

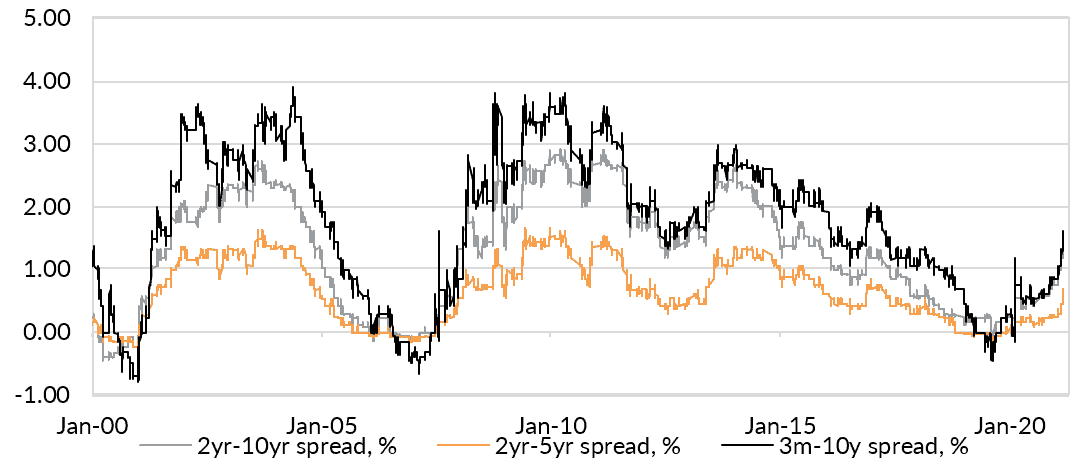

Longer-dated nominal bond yields are moving higher globally. The Australian 10-year yield was 95bps higher over February, and the US 10-year yield was 45bps higher. Shorter-dated bond yields have increased by less as central banks remain committed to accommodative monetary policy. This has steepened yield curves globally. In the US, the difference in yield between longer-dated and shorter-dated yields is at it the widest level since 2017 (Figure 2).

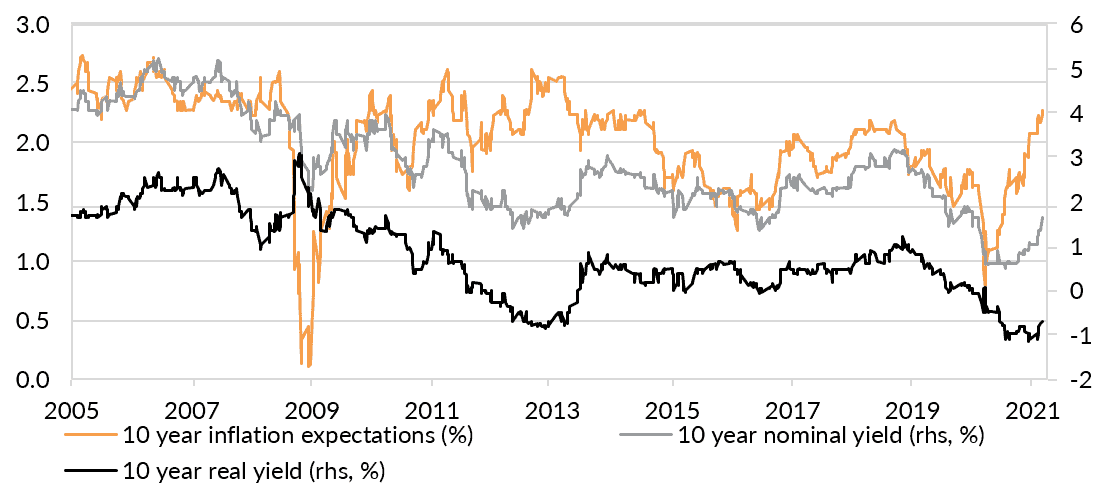

Higher yields reflects the interplay between higher inflation expectations and better growth outlooks. Inflation expectations have normalised and are back at levels last seen in 2015 in the US (Figure 2). But the real (inflation-adjusted) yield has also started to rise in the US (Figure 3). This indicates that real growth expectations are also on the rise. We think that will be reflected in revised higher earnings expectations – and will be a tailwind for equity returns in the medium-term.

In the nearer-term, higher bond yields are challenging elevated prices for parts of the equity market. This is particularly the case for technology and growth stocks. We think it is important to focus on the positive message from the real yield market, and look through the volatility.

Figure 2: US Treasury yield curves have steepened as longer-dated yields have increased.

Figure 3: Inflation expectations and real growth expectations have increased.

What can we do about it?

We have had a moderately unattractive view on sovereign bond yields since May 2020. Reducing exposure to those assets in mid-2020 cushioned the impact from higher yields now. We still think sovereign bonds have an important role to play in portfolios. They act as a downside risk hedge – even more so as bond yields have moved higher.

We think it is important not to panic through this nearer-term volatility. Knee-jerk reactions reducing bond exposure or equity exposure could be costly in the medium-term. We remain focused on the real yield as an important indicator for the medium-term. The movement in this important market remains contained and orderly.

Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).