Search posts

Mind The Gap

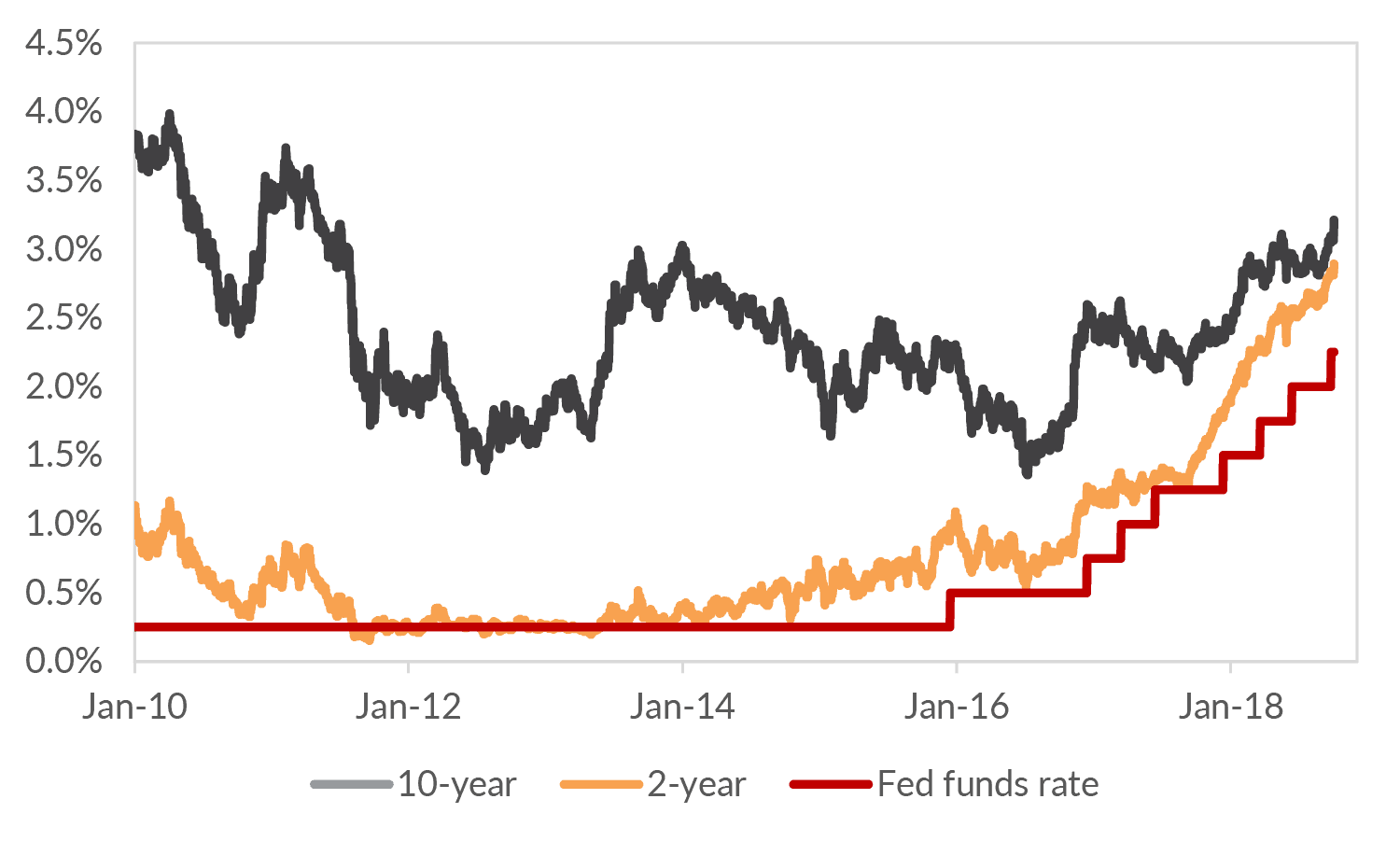

US 10-year Treasury yields gapped higher in early October. The yield has now reached 3.18%, the highest level since 2011. A higher yield can have meaningful impacts on other asset classes. It can also impact the economy. We continue to believe that the US is headed for recession in 2020. What does the gap higher in yields tell us? And what should we be keeping an eye out for?

Figure 1: US 10-year yields have reached the highest level since 2011

What has happened to US Treasuries?

The 10-year yield increased more than the 2-year yield. This widened the spread between the two yields to 31bps, the widest since July this year (Figure 2).

Figure 2: The spread between 10-year and 2-year US Treasury yields has widened

Why has it happened?

What drove yields higher? It is always difficult to assign reasons to single events. But we expect yields have moved higher and will move higher still for at least three reasons:

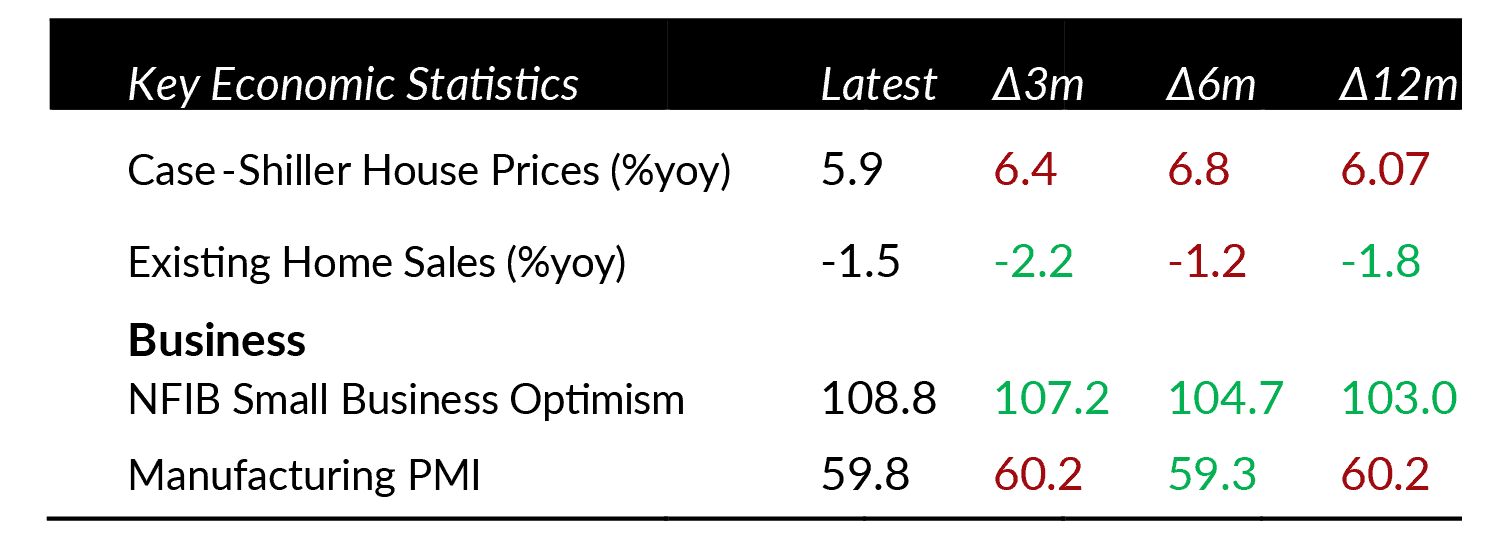

- Solid economic data in the US – in particular labour market data and services sector data (green indicate the latest data have improved, red that it is weaker)

Table: Economic data have been solid in the US

- A growing realization in the market that the Fed will deliver more rate hikes over the coming 18 months.

- A shift in market positioning. The initial gap higher suggests a capitulation in positioning for technical reasons. That could continue as bearish sentiment on bonds pushes yields even higher.

What will higher yields mean?

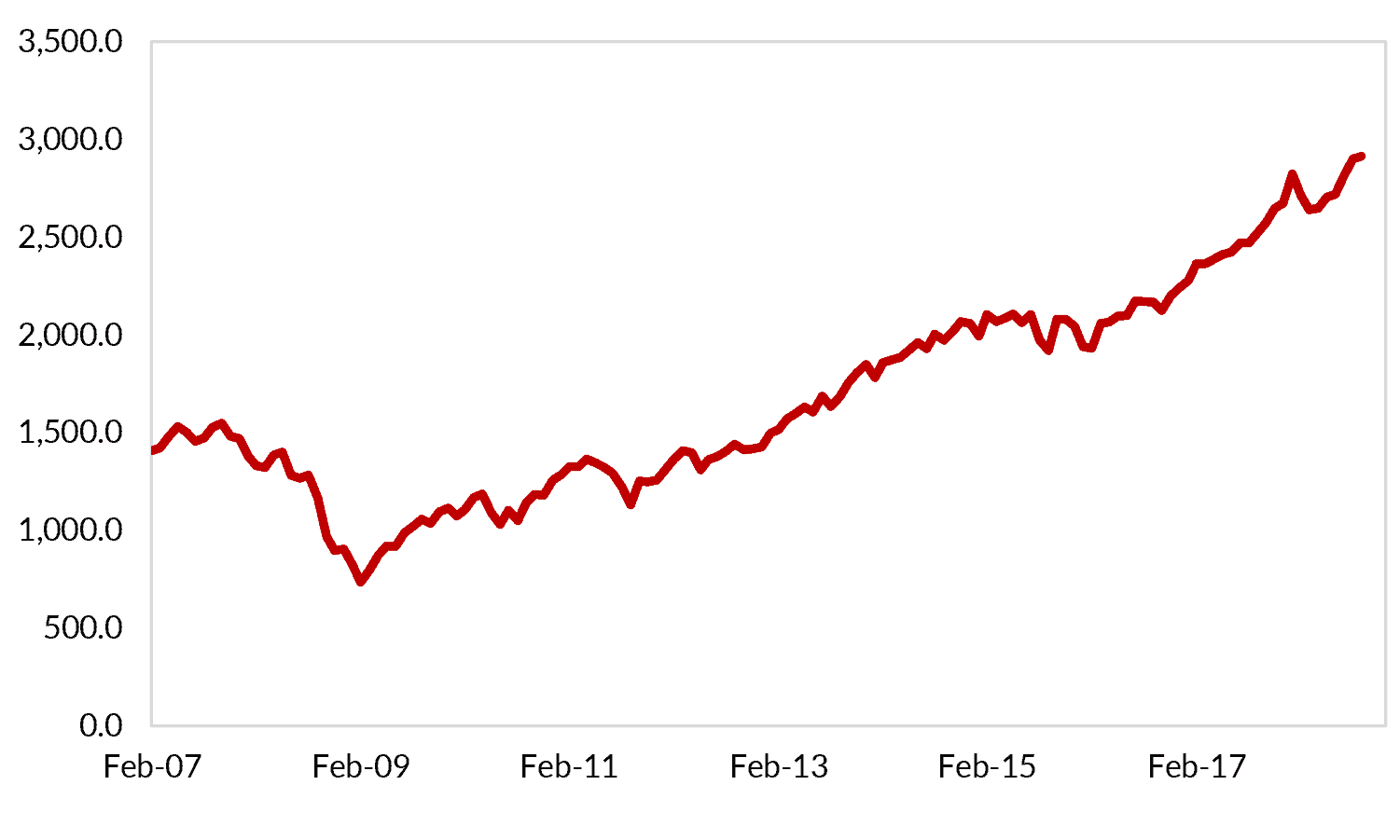

Higher bond yields have implications for equities and fixed income returns. Higher bond yields increase the rate at which equity cash flows are discounted back to fair value. Directly, this can put downwards pressure on equity prices. But US equity prices have continued to rally (Figure 3).

Figure 3: The S&P500 has reached record highs

I expect that solid economic growth and late-cycle dynamics (including elevated merger and acquisition activity and share buybacks) will continue to support US equity returns over the near term. Over the medium term, we remain concerned about a likely recession in 2020. For fixed income, higher bond yields do not necessarily mean negative returns. However, it is can be important to reduce exposure to longer-duration bonds that have prices which are more sensitive to interest rate changes. It is also important to move up the credit spectrum to higher quality credits. Lower quality credits face greater default risk as the cost of servicing debt increases.

I expect that solid economic growth and late-cycle dynamics (including elevated merger and acquisition activity and share buybacks) will continue to support US equity returns over the near term. Over the medium term, we remain concerned about a likely recession in 2020. For fixed income, higher bond yields do not necessarily mean negative returns. However, it is can be important to reduce exposure to longer-duration bonds that have prices which are more sensitive to interest rate changes. It is also important to move up the credit spectrum to higher quality credits. Lower quality credits face greater default risk as the cost of servicing debt increases.

What have we done?

We moved our portfolios to be positioned for higher US Treasury rates and rising US equities in early June. We expect these portfolios will continue to perform in the current environment. If you are interested in discussing how we can help adjust your portfolio to deal with the global outlook please get in touch with your advisor or with Oreana Private Wealth here.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorized copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorized personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorized use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).