Portfolio

Management

Portfolios that protect through the economic cycle

We create and deliver solutions that help manage risk and grow wealth to achieve your mission and objectives. We have an institutional background but adopt a flexible, consultative approach, and we aim to be your trusted partner through your investment journey.

The Oreana Portfolio Advisory Service

The Portfolio Advisory Service (PAS) is an institutional-grade Investment Consulting service which provides a better and differentiated experience for our clients. We build and manage portfolios that will protect through the economic and investment cycle with a robust investment process, a deeply experienced and qualified team with a focus on achieving investment objectives. Our transparent, collaborative and repeatable service sets us apart and helps us improve your investment experience for the better.

A Robust Investment Program

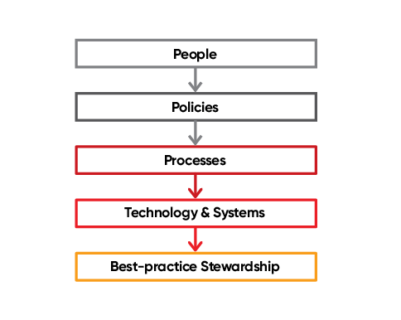

PAS incorporates a robust set of end-to-end investment governance and risk management processes.

An Experienced & Capable Team

PAS offers a tailored range of investment capabilities for investors in the Asia Pacific markets.

Solutions & Ongoing Service Packages

PAS provides a range of portfolio implementation opportunities that optimize risk-adjusted returns.

Transparent, Collaborative Service

PAS is committed to a clear, transparent service with ongoing collaboration, continuous improvement and innovation.

PAS Signpost Series: Overview

Our ESG White Paper

Our whitepaper Sustainable Investing: Key concepts, trends and developments is designed to help our clients understand the how, what, and why of sustainable and ESG investing, in a simple, jargon busting format.

It provides an overview of key sustainable investing concepts, trends, and developments. And we provide some key takeaways and considerations for investors considering implementing investments within a sustainable framework.

Sustainable Investing: Key concepts, trends and developments

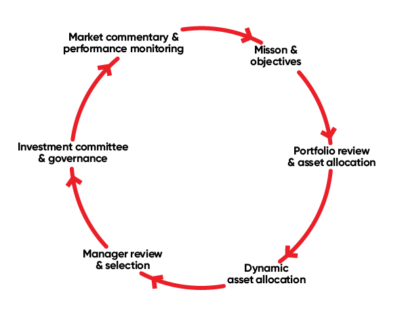

A Repeatable Process

We follow a clear process to map your mission and objectives to investment outcomes. Risk management and governance are key to the process.

Mission and Objectives

Our process starts with you – your mission, your objectives, your goals. Our Investment management process is a framework for maximising the likelihood that you achieve your objectives.

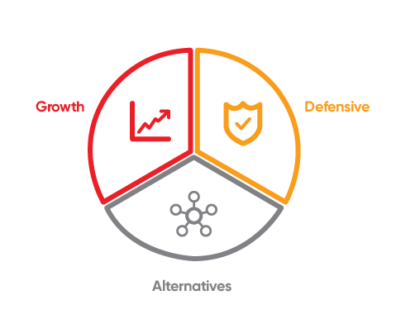

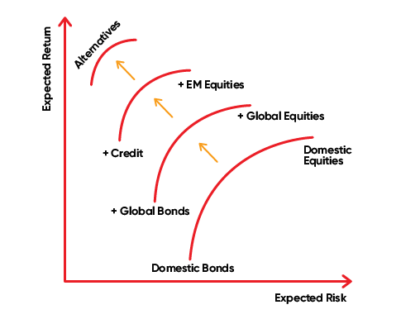

Portfolio Construction

We use a repeatable process to determine long-term asset allocation targets. This helps us diversify across a range of asset classes and repeatably manage risk and return to increase the likelihood of achieving your mission and objectives.

PAS Signpost Series: Strategic Asset Allocation

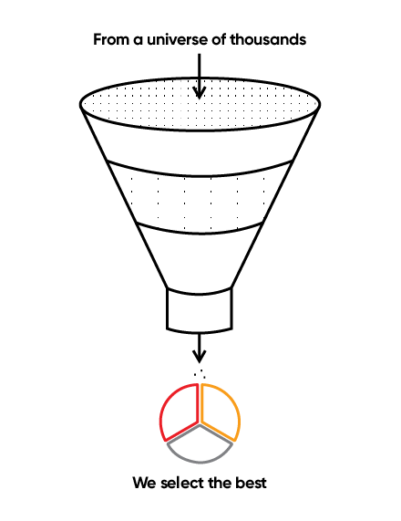

Manager Research and Selection

Our expert Manager Research Team is experienced with a repeatable process supported by deep quantitative research and a clear, actionable set of core beliefs. We choose the best managers from a universe of thousands to support portfolio returns and risk management – all aimed at achieving your long-term goals.

PAS Signpost Series: Manager Research & Selection

Asset Allocation

Our asset allocation is disciplined, repeatable and managed within a clear risk framework. We can make changes to reduce exposure to downside risks, protecting your wealth and supporting your journey towards your mission.likelihood of achieving your mission and objectives.

PAS Signpost Series: Dynamic Asset Allocation

Governance

Good governance is critical in managing risks that could result in you missing your long-term objective. Our investment management governance framework is clear, robust, internally and externally reviewed and managed by global experts in the field.

PAS Signpost Series: Governance

Performance Monitoring, Reporting and Commentary

We believe you should know where you stand in relation to your mission and objectives. You should be informed about potential events – economic and political – that could impact your wealth. We use a clear, frequent and transparent set of communications to keep you up to date. That includes annual, quarterly and monthly reports, webcasts and blogs that you can choose to access at any time.

Not what you’re looking for?

Check out our other Services!

Financial Advice and Planning

Failing to plan is planning to fail. When it comes to important life goals, making a wish list is just the first step. You need professional advice to turn your aspirations into reality.

Private Wealth Management

Today’s financial landscape won’t be the same tomorrow. How do you make investment choices with the right balance between your current objectives and future realities?

Specialist Expatriate Services

The prospect of an expatriate posting can be very exciting. At the same time, it can also be very daunting, especially when it comes to your financial arrangements. We can help.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).