Search posts

It’s the economy, stupid!

A phrase coined by James Carville during the 1992 presidential campaign is as relevant now as it was then. Carville helped former-President Bill Clinton to victory during a US recession. Now, with Joe Biden as President-elect, the focus will turn to the economic recovery from the Covid19 recession. That recovery is already underway, and we expect it will gather momentum over 2021 helping to propel risk assets higher.

A durable recovery is already underway

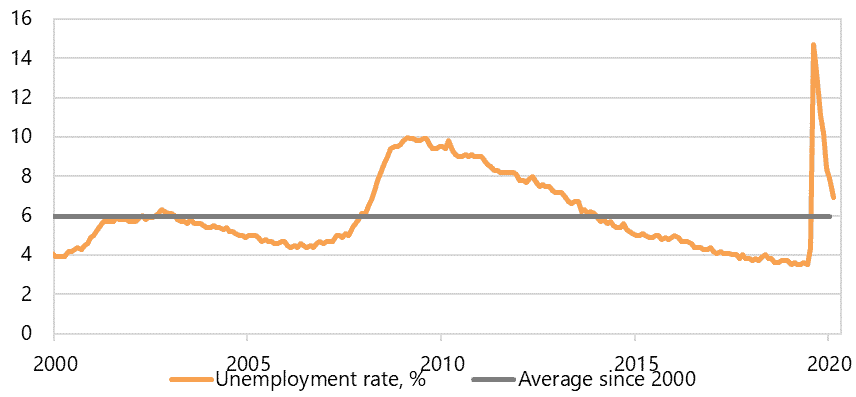

The US economy has been recovering for some time. GDP increased 33.1% annualised in Q3. It was from a low base, but it confirms clear signs of recovery elsewhere. US retail sales are higher now than they were in December 2019. The housing sector is performing well. And the unemployment rate fell back to 6.9%. That compares to 14.7% at the peak in April this year (Fig 1).

Fig 1: The unemployment rate is recovering rapidly from the peak in April 2020.

The election was a red herring

We wrote last month that investors needed to focus on the big picture for the election. And the big picture was monetary and fiscal policy stimulus. We expect the US Federal Reserve would continue to be ultra-accommodative with monetary policy. And we expect fiscal stimulus will be forthcoming. We saw this as the case regardless of who won the election. Focusing on the noisy, blustery campaign would be a near-term distraction from the ongoing economic recovery.

Covid19 means pent-up demand

Our view has been predicated on the likelihood of a vaccine. We don’t know when it will be available. But our simplistic view has been that each day brings us closer to that vaccine. Our base case is that consumer and business preferences will not change materially as a result of the election. Households will still want to spend. Businesses will still need to invest. We think that means pent-up demand when governments, households, businesses and countries are able to exit Covid19 restrictions. And that means very strong GDP growth in 2021.

Equity markets were not pricing this outlook

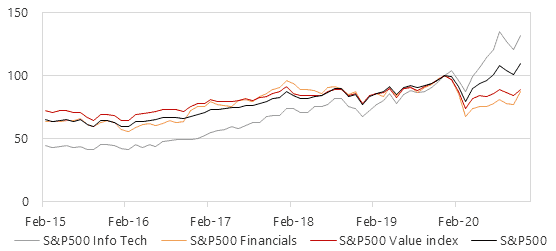

Equity markets have rallied from the early-2020 Covid19 troughs. We think that markets have been pricing in low rates for an extended period. That has supported large growth stocks that have driven the rally (Fig 2).

Fig 2: Tech stocks have led the equity market recovery in the US.

But the solid growth outlook, an earnings recovery that will begin in earnest in 2021, and conditions that will continue to favour corporate buybacks is yet to be fully priced. Our monthly Asset Allocation Review shows that we moved to a neutral position in US equities in mid-March after entering 2020 with an underweight position. By June we were overweight equities. We continue to think that US equities will offer returns above historical averages over the coming five years.

But the solid growth outlook, an earnings recovery that will begin in earnest in 2021, and conditions that will continue to favour corporate buybacks is yet to be fully priced. Our monthly Asset Allocation Review shows that we moved to a neutral position in US equities in mid-March after entering 2020 with an underweight position. By June we were overweight equities. We continue to think that US equities will offer returns above historical averages over the coming five years.

Remain focused on the fundamentals

Markets can be noisy and volatile. There may be more volatility to come in the wake of the election. But as James Carville urged Bill Clinton in 1992, it is the economy that matters. And the big picture now is that the US is entering a sustainable, lengthy period of growth. For us, that has involved adding to risk positions since the economy troughed in March. We were able to re-risk the portfolio as we said we would in our 2020 Medium-term Global Outlook, released in February this year. Reach out to our Portfolio Advisory Service to find out how we can assist you with managing your investment challenges.

This presentation material and all the information contained herein is the property of Oreana Financial Services Limited (OFS), and is protected from unauthorised copying and dissemination by copyright laws with all rights reserved. This presentation material, original or copy, is reserved for use by authorised personnel within OFS only and is strictly prohibited from public use and/or circulation. OFS disclaims any responsibility from any consequences arising from the unauthorised use and/or circulation of this presentation material by any party. This presentation material is intended to provide general information on the background and services OFS. No information within this presentation material constitutes a solicitation or an offer to purchase or sell any securities or investment advice of any kind. The analytical information within this presentation material is obtained from sources believed to be reliable. With respect to the information concerning investment referenced in this presentation material, certain assumptions may have been made by the sources quoted in compiling such information and changes in such assumptions may have a material impact on the information presented in this presentation material. In providing this presentation material, OFS makes no (i) express warranties concerning this presentation material; (ii) implied warranties concerning this presentation material (including, without limitation, warranties of merchantability, accuracy, or fitness for a particular purpose); (iii) express or implied warranty concerning the completeness or relevancy of this presentation material and the information contained herein. Past performance of the investment referenced in this presentation material is not necessarily indicative of future performance. Investment involves risks. Investors should refer to the Risk Disclosure Statements & Terms and Conditions of the relevant document for further details. This material has not been reviewed by the Securities and Futures Commission of Hong Kong.

Insights

Read our latest insights to help you make better investment decisions and build stronger portfolios.

A Licensed Financial Firm

In Hong Kong we are licensed by the Securities and Futures Commission (license no. AHX191), the Insurance Authority (license no. FB1443) and the Mandatory Provident Fund Authority (license no. IC000563).

In Australia we are licensed by the Australian Securities and Investments Commission (AFSL No: 482234, ABN 91 607 515 122).